USCTI/AMT

This total, as reported by companies participating in the Cutting Tool Market Report (CTMR) collaboration, was down 1.9% from March's $210.4 million and up 1.3% when compared with the $203.7 million reported for April 2018. With a year-to-date total of $837.4 million, 2019 is up 6.7% when compared with 2018. These numbers and all data in this report are based on the totals reported by the companies participating in the CTMR program. The totals here represent the majority of the U.S. market for cutting tools.

“April’s report continues to reflect a very robust market. However, the growth rate appears to beslowing. This is in line with what other industries are reporting. The effect of reduced Boeing 737 production rates and unsettled trade agreements are causing some of the market headwinds. If those issues are resolved in the next couple of months, 2019 could end as another record year,” says Phil Kurtz, president of USCTI.

According to Mark Killion, director of U.S. Industries at Oxford Economics, "New orders fell back in April, although remaining above year-ago levels, in line with slowing business investment and weakness in the motor vehicles sector."

Historical data for the Cutting Tool Market Report is available dating back to January 2012. This collaboration of AMT and USCTI is the first step in the two associations working together to promote and support U.S.-based manufacturers of cutting tool technology.

Latest from Today's Medical Developments

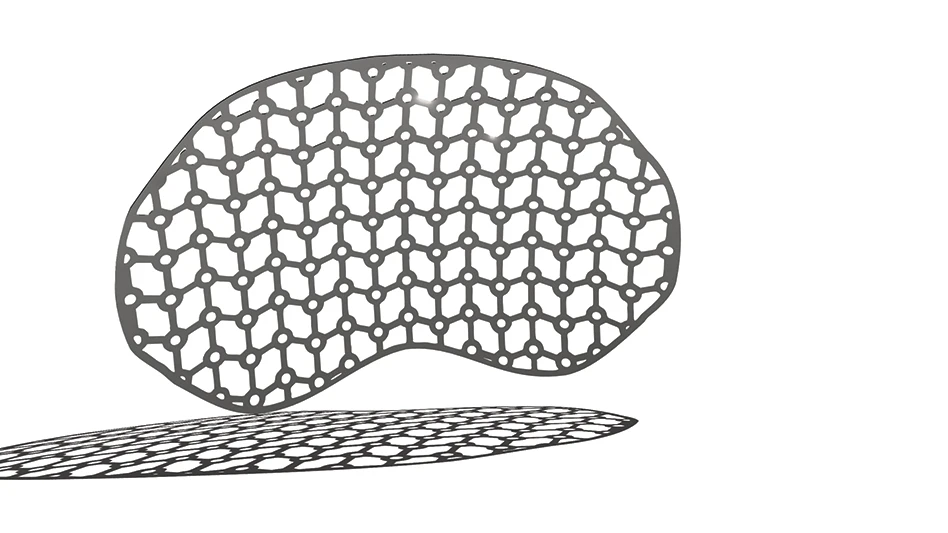

- Stryker’s flexible syndesmotic fixation device stabilizes ankle injuries

- Mergers & acquisitions news: MGS, Quantum Surgical bolster medtech portfolios

- Exchangeable-head solid carbide cutting tools

- NextDent 300 MultiJet printer delivers a “Coming of Age for Digital Dentistry” at Evolution Dental Solutions

- Get recognized for bringing manufacturing back to North America

- Adaptive Coolant Flow improves energy efficiency

- VOLTAS opens coworking space for medical device manufacturers

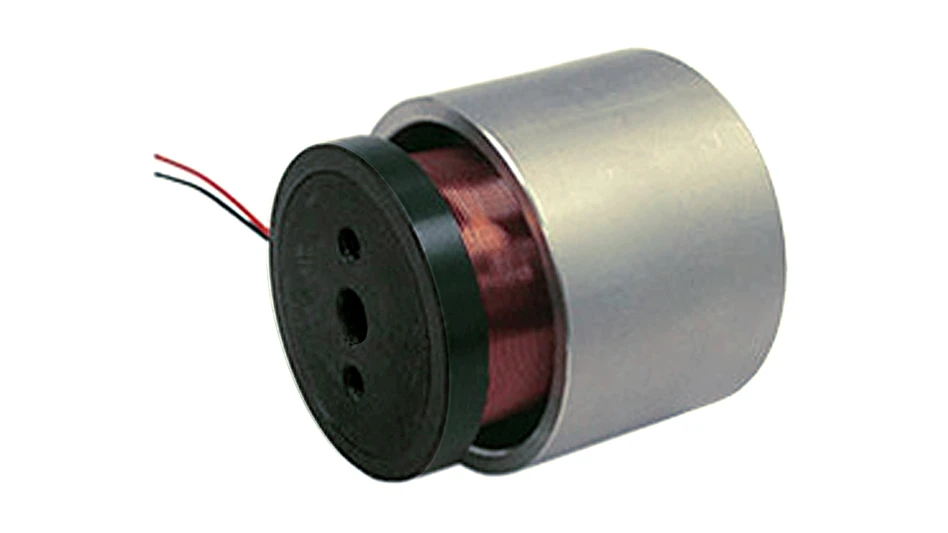

- MEMS accelerometer for medical implants, wearables