As mergers and acquisitions (M&A) advisors, we’re often asked by medtech business owners about the value of their business. However, there are no simple answers because there are so many variables involved. That said, there are some general guidelines that can help you assess the potential valuation of your business.

Some of the key factors that impact the intrinsic value of your business include:

- Timing – As in many things in life, in M&A, Timing is everything!

- Size – It’s also true that in M&A, Size does matter!

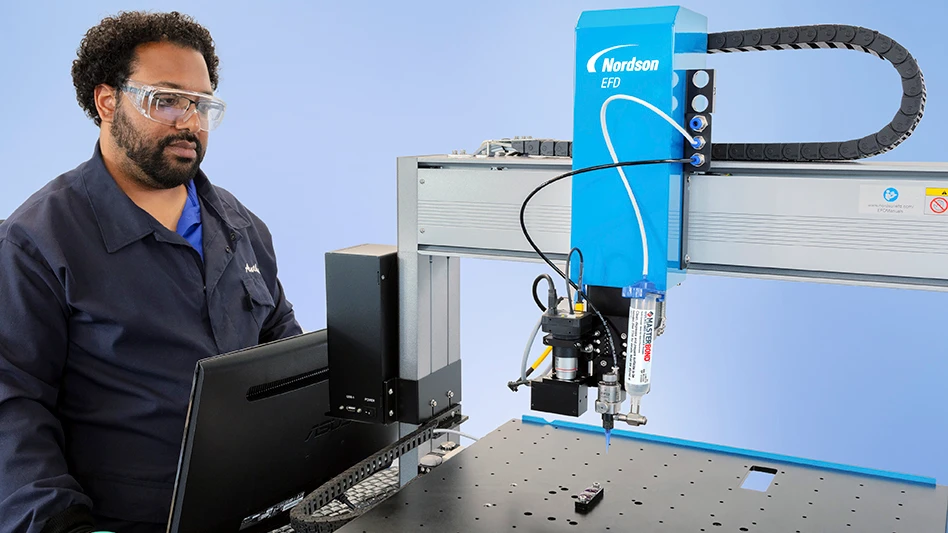

- Assets – Beyond the core value of your business, the type (and quantity) of your assets can contribute to valuation. You want a potential buyer to say: Nice assets!

- Team – If you sell your business, can your team manage the day-to-day operations of the company with a new owner? In other words – (the right) People add value!

Some general guidelines for likely value expectations for your business are in the table.

As you may have noted, there’s a wide range of multiples due to so many factors involved with each company’s M&A scenario. It’s often helpful to speak to an M&A advisor to get a better idea of what the current valuation opportunities are for your specific entity.

It’s also known that the market always decides valuation. Unless someone is handing you a check with a specific amount for your company, run away from anyone who guarantees they can obtain a certain valuation for your business. If you do decide to sell your business, ensure that your specific value proposition is heard by the appropriate potential buyers for your business. And if you’re not ready to sell, it’s important to pay attention to your business fundamentals so you have the opportunity to obtain the best valuation in the future when the timing is right.

MedWorld Advisors

https://medworldadvisors.com

| Type of business | EBITDA* multiple | Revenue* multiple | Valuation notes | Likely buyers |

|---|---|---|---|---|

| Emerging Growth (Pre-revenue or early stage) | NA | NA | Value based on market opportunity and clinical economic evidence | Venture capitalist (VC) as investors, or strategics as buyers |

| Private - Small (Under $10 million in sales) | 4x to 6x | 1x | Sustainability and team are key | Individuals or private equity (PE) bolt-ons |

| Private – Middle Market (Between $10 million and $200 million in sales) | 6x to 12x | 1x to 2x | High competition for these companies IF EBITDA is >15% | PE, competitor, or strategic |

| Private – Large (Over $200 million in sales) | 8x to 20x | 1x to 6x | High competition from all buyers | PE, competitor, strategic, or SPAC** |

| Public | 12x to 20x | 2x to 6x | Will often obtain a premium over current stock price | PE, competitor, or public strategic |

Explore the May 2021 Issue

Check out more from this issue and find your next story to read.

Latest from Today's Medical Developments

- Syringe-less injector system for diagnostic imaging obtains fourth FDA clearance

- Hohenstein Medical debuts enhanced medical device testing capabilities

- Arterex unveils unified brand identity

- Dymax demonstrates light-curing material solutions for medical devices

- Able Medical Devices showcases latest sternal closure solutions

- TMTS 2026 explores AI-powered sustainable manufacturing and more

- QT9 QMS platform streamlines quality management, compliance for medical device manufacturers

- Spineology releases patient-specific expandable spinal implant