Cleveland, Ohio – The global orthopedic devices medical market is expected to reach $43.1 billion by 2024, according to a new report published by Grand View Research Inc. Major drivers of the medical device market include the rising demand for orthopedic surgeries owing to the growth in road accidents and the prevalence of orthopedic diseases.

Top 5 orthopedic device market findings are:

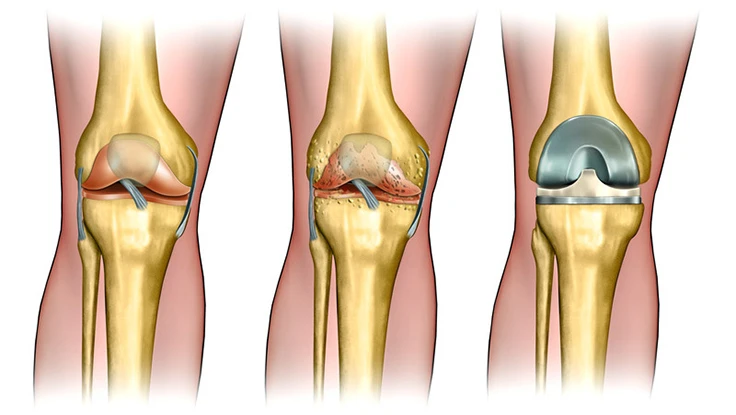

- The knee orthopedic devices segment captured the largest share of the market in 2015. This was attributed to the factors such as a high rate of knee surgeries including common knee injuries to total knee replacements.

- The hip orthopedic devices segment was the second largest market in 2015. The large portfolio for hip injury management is expected to result in a significant share in the global market.

- North America captured the largest market share of 51.4% in 2015 and is expected to maintain its dominance over the forecast period. The presence of a large number of major market players and a high adoption rate of advanced technologies are the factors driving the growth of the market in the region.

- The Asia Pacific market is expected to witness a lucrative CAGR of 8.6% during the forecast period. The presence of a large untapped market and the availability of supportive government regulations are expected to attract the attention of the global players.

- The introduction of new products made of materials, such as various types of ceramics and polymers, has led to a rise in the success rates of surgeries. In addition, these products are available at affordable costs and customizable sizes and shapes. As a result, the adoption of these advanced products is swiftly increasing.

The global orthopedic devices market was valued at $29.7 billion in 2015. The growing prevalence of orthopedic conditions, such as degenerative bone disease and rising number of road accidents are the major factors driving the market growth. In addition, obesity and sedentary lifestyles resulting in the early onset of musculoskeletal conditions are expected to boost the market growth during the forecast period.

The currently available trauma management treatments are not capable of restoring the body parts successfully owing to the unavailability of efficient surgical tools. As a result, manufacturers are investing in the research and development to introduce innovative and efficient devices for the treatment of trauma management.

The growing awareness regarding the availability of innovative products among patients is pushing hospitals to constantly upgrade the devices and services they offer. In addition, the reimbursement coverage of orthopedic treatments has fueled the adoption of orthopedic surgeries. All the above-mentioned factors are positively impacting the market growth.

Stringent regulatory approval procedures by the U.S. Food and Drug Administration (FDA) and the high cost of the devices and procedures are some of the factors impeding the growth of the market. Stringent regulations majorly delay the approval of Class III and IV devices in the U.S. On the other hand, the approval of class III and IV devices is relatively easy in Europe.

Segment insights

The knee orthopedic devices market captured the largest share in 2015 and is expected to maintain its dominance over the forecast period. The growth of the segment is mainly attributed to the rising prevalence of knee conditions across all age groups and the availability of a wide range of products.

The foot and ankle segment is expected to witness the fastest growth rate during the forecast period. A rise in sports injuries coupled with an increasing awareness regarding the availability of treatments for sports injuries is anticipated fuel the demand for orthopedic equipment in foot and ankle applications.

A high demand for devices that support immediate cure is anticipated to trigger the entry of innovative products in the market. In addition, sports organizations working to boost the morale of sportspersons disabled by sports injuries are expected to boost the research and development of orthopedic devices in the sports.

Regional insights

The North America orthopedic devices market dominated, with a revenue share of 51.4% in 2015. A high demand for advanced healthcare services owing to the availability of the well-developed healthcare infrastructure and reimbursement coverage are some of the factors driving the growth of the North America orthopedic devices market. In addition, the constantly rising target patient population owing to aging, and rising car accidents are fueling the demand for orthopedic surgeries in the regions. As a result, North America is anticipated to maintain its dominance throughout the forecast period.

The Asia Pacific orthopedic devices market is expected to exhibit the fastest growth during the forecast period. China and India are together expected to account for the largest geriatric population pool across the world. As a result, the demand for orthopedic surgeries in China and India is expected to grow tremendously in the near future. In addition, the booming medical tourism industry in the region owing to the availability of advanced healthcare treatments at a cheaper cost is expected to attract the target patient population to Asia Pacific. Therefore, Asia Pacific is anticipated to reach $7.5 billion in 2024.

Competitive insights

The global orthopedic devices market is oligopolistic with a few international players capturing over 80% of the global market share. Major players in this market are Medtronic PLC, Stryker Corp., Zimmer-Biomet Holdings Inc, DePuySynthes, Smith and Nephew PLC, Aesculap Implant Systems LLC, Conmed Corp., Donjoy Inc., and NuVasive Inc.

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

Latest from Today's Medical Developments

- AI will power the next generation of medical wearables

- CUI Crash Course from Smithers

- Revolutionary implant harnesses electricity for healing

- Discover the advantages of Oerlikon's latest Surface Two technology

- #48 Lunch + Learn Podcast with OPEN MIND Technologies

- CERATIZIT achieves SBTi validation for emissions goals

- Applied Motion Products’ MLA & MEA series linear actuators

- Arterex expands portfolio with Xponent Global acquisition