There is a stiff price to pay for those who choose not to consult with knowledgeable suppliers when outsourcing metal tubing for medical devices. Unless certain steps are taken to ensure that designs and specifications are accurate, the potential consequences include: exceeded R&D budgets, exorbitant production costs, delay of FDA approval, slowed speed to market, and a great deal of frustration.

There is a stiff price to pay for those who choose not to consult with knowledgeable suppliers when outsourcing metal tubing for medical devices. Unless certain steps are taken to ensure that designs and specifications are accurate, the potential consequences include: exceeded R&D budgets, exorbitant production costs, delay of FDA approval, slowed speed to market, and a great deal of frustration.

By qualifying and partnering with a metal tube supplier, most of the pitfalls that cause such problems can be identified and avoided.

“A big pitfall that we run into is that a lot of engineers will look at tolerances in terms of the upper and lower extremes, they do not take into account tolerance stacking, effects of secondary operations, ID clearance issues, etc. If these items are not specified properly and prototype runs are ordered, the engineer looses their monetary investment, and more importantly time, which translates into time to market, missed product release deadlines, or even worse…recalls,” says Lance Heft, CEO of International Tube, a major supplier of metal tubes to the medical device industry. “These are critical factors that you often run into in production runs. So, we will bring those types of questions up in the initial meeting with a customer to make sure the engineers get what they want in their initial prototype run.”

Here are five other pitfalls that OEMs, engineers, and procurement people can avoid when outsourcing metal tubing used in medical devices.

Using Unqualified Input

We live in the Age of Information, yet it is essential to remember that not all information is accurate. Many engineers will refer to Internet sites for information on metals and their corresponding mechanical and chemical properties. “While such information may be convincing, it is often misleading,” Heft says. “The trouble with the Internet, and even some reference books, is that they may encourage the selection of an exotic material that could be unavailable or inappropriate for the application. We see this all the time. Your supplier should explain such issues; they should be knowledgeable of the application and make suggestions regarding alloys and design factors.”

Heft adds that the collaborative relationship is often most important to smaller and mid-size medical device manufacturers who do not have the range of experience with metallurgy and applications that the tube supplier should have. Additionally, it is important to fully understand the different manufacturing methods of tubing, and how this relates to the performance of the end product.

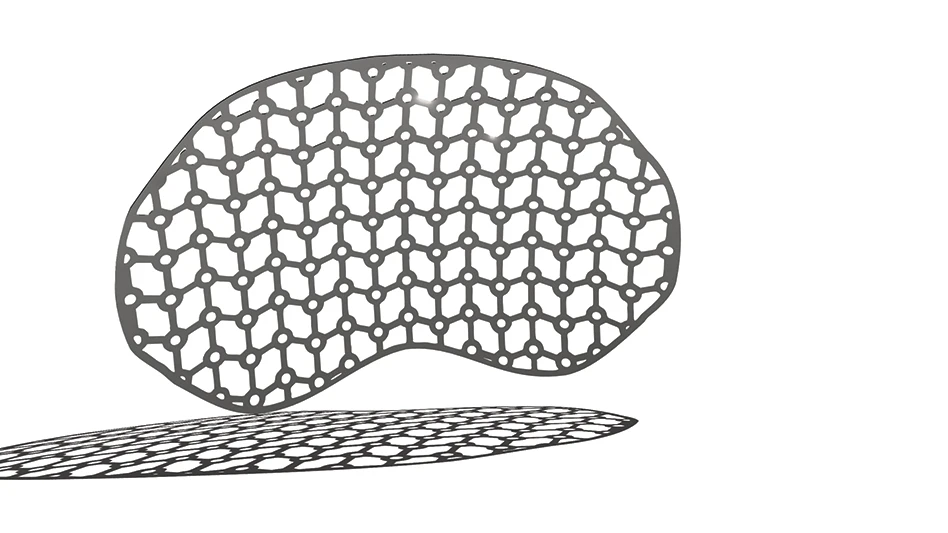

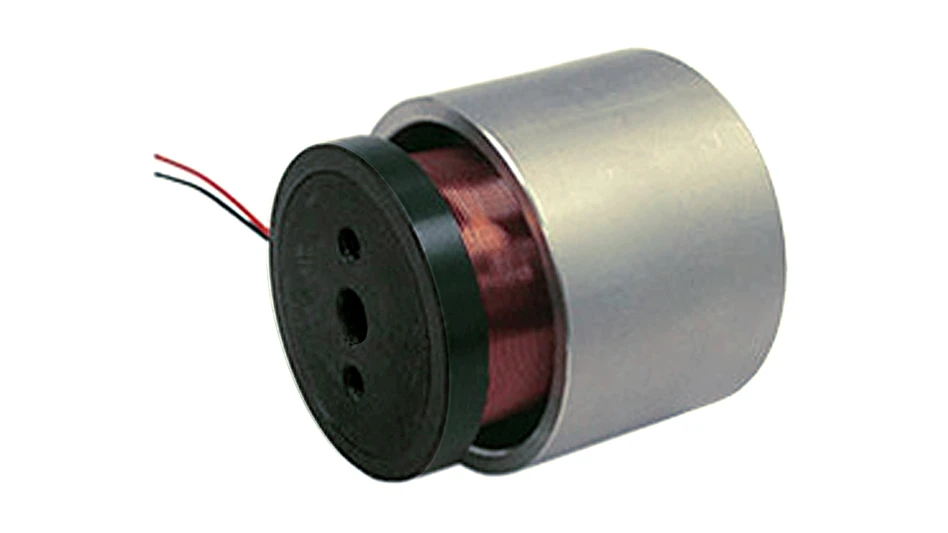

Many tube designs and configurations include fabrication challenges such as metallurgy, tube formation and configuration, tensile strengths, cost, structural characteristics, and coatings. These may include bulges, flairs, and swages that are difficult to perform, yet may be vital to the performance of a device. So, it is important to confirm that your supplier has experience with such configurations.

Under- or Over-Estimating

Prospective vendors should be qualified according to their experience with an application to validate tubing requirements. For instance, small-diameter tubing is becoming increasingly important because medical devices continue to become more miniaturized.

“This creates a need to put more materials or devices through a smaller ID tube,” Heft explains. “When you put multiple devices, such as fiber optics, other tubes, guidewires, and even stents, through a laparoscopic or endoscopic tube, for example, you get a stack-up of tolerances. That results in costly problems. So, it becomes much more important that the ID is accurate, the inner surface is smooth without burrs, roughness, or debris, and that the instrument is engineered so that it does not develop kinks.

“Our knowledge comes in right from the start. It is scary to say, but it has happened, where a customer will come to us and ask for 316 or 304 stainless and then we find out that they are using it for an implanted device,” Heft states. “That is not implant-grade material, so we have to make them aware that they need an implant-grade material, and help them understand the properties and why they are important.”

Fully understanding the tube application can lead to optimum functionality, plus cost savings. Having access to specialized engineers at the vendor level helps to define device quality requirements and also ensures consideration of solutions to both current and future requirements.

Quality Correlation

It is vital for the vendor to ensure that the tube can perform to the level of quality expected, and it is extremely important to find a provider that makes sure quality measurement techniques are correlated between both parties, products are being inspected properly, and products are being run through the necessary tests to make sure they perform.

“Correlation does not come up as often as it should,” Heft says. “In some cases engineering handles the mechanics and functionality of the device. But, there is a separate quality division. They have the responsibility to ensure that however the device has been specified, even if it has been specified wrong, it is going to comply with their print.”

A thorough supplier of metal tubes will eliminate such design problems before they become product problems. They know how different alloys are produced and fabricated, and the various mechanical and chemical properties that are available from different materials, as well as what fabrications can realistically be expected and how far the envelope can be pushed.

Quality credentials may also be important. Many suppliers of medical device components are ISO-9001 certified. But when a vendor has ISO-13485 certification, that credential indicates a supplier has very high quality standards, not only in products, but also systems. “With the FDA and other governing authorities becoming more and more involved in the monitoring of a medical device company’s activities and quality, they better have a vendor that has 13485 compliance. The FDA is getting more and more active, and this is another level of comfort for them,” Heft explains.

Turnaround Traps

Speed to market often depends on prototype turnaround. Look for a metal tube supplier who can provide quick turnaround of prototypes, which can often be done within weeks, or even days. However, whether for prototypes or volume orders for approved tubes, choose vendors who provide realistic delivery dates; in some cases, larger suppliers take orders without knowing how quickly they can respond, estimating volume deliveries in eight weeks that in reality will take three to six months.

“Generally, a metal tube fabricator is always looking at lead time,” Heft says. “With International Tube, that could be anywhere from a couple of days to six weeks for prototypes. We have also made it a point to become a one-stop supplier. That enables us to avoid making errors when we promise short lead times. No one is perfect, but if we say a week, we hit it, even if that means I have to drive the package to the airport to get it there on time.”

Communications

When outsourcing metal tubes or other critical components, partner with a specialist with good communications skills and systems.

“Proactive communication is an important supplier qualification,” Heft says. “That does not seem to resonate as much today as it should. But it is important that you do not rely on suppliers who are simply order takers. This is a critical interface between the supplier and customer. If you do not have a high level of knowledge, experience, and communications from the sales rep or consultant, you may run into many difficulties that could otherwise be avoided.”

International Tube

Pottstown, PA

internationaltube.com

Explore the April 2010 Issue

Check out more from this issue and find your next story to read.

Latest from Today's Medical Developments

- Stryker’s flexible syndesmotic fixation device stabilizes ankle injuries

- Mergers & acquisitions news: MGS, Quantum Surgical bolster medtech portfolios

- Exchangeable-head solid carbide cutting tools

- NextDent 300 MultiJet printer delivers a “Coming of Age for Digital Dentistry” at Evolution Dental Solutions

- Get recognized for bringing manufacturing back to North America

- Adaptive Coolant Flow improves energy efficiency

- VOLTAS opens coworking space for medical device manufacturers

- MEMS accelerometer for medical implants, wearables