Each year the Cleveland Clinic unveils the Top 10 Medical Innovations during their Medical Innovation Summit, the list chosen for 2012 highlights the changing market due to the approaches, techniques, and therapies addressed. Selected by a panel of Cleveland Clinic physicians and scientists the innovations are:

Each year the Cleveland Clinic unveils the Top 10 Medical Innovations during their Medical Innovation Summit, the list chosen for 2012 highlights the changing market due to the approaches, techniques, and therapies addressed. Selected by a panel of Cleveland Clinic physicians and scientists the innovations are:

10. Genetically modified mosquitoes to reduce disease threat

9. Novel diabetes therapy: SGLT2 inhibitors

8. Harnessing big data to improve health care

7. Active bionic prosthesis: wearable robotic devices

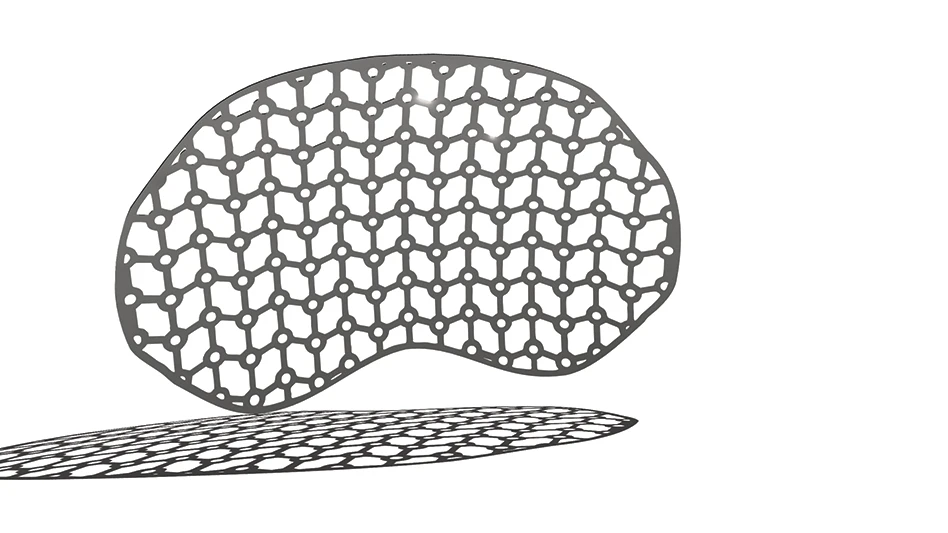

6. Implantable device to treat complex brain aneurysms

5. Increasing discovery with next-generation gene sequencing

4. Medical Apps for mobile devices

3. Concussion management systems for athletes

2. CT scans for early detection of lung cancer

1. Cather-based renal denervation to control resistant hypertension

So why begin with a list of the predicted Top 10 Innovations? Simple, innovations make this industry exciting, and are the reason it is constantly changing and always growing.

Size, Structure

PwC, formerly Pricewaterhouse Coopers, puts the global medical technology industry at approximately $350 billion.

Espicom, in their research, places the U.S. medical device market at roughly $105.8 billion for 2011. Therefore, the industry is large, and continues to grow thanks to baby boomers and increasing life expectancies.

Accenture released a report last fall, Achieving High Performance: Reinventing Medical Technology for a Dramatically Different Future, which offers a look at the rapidly changing dynamics of the medical technology industry. Researchers note that the medical technology industry, while growing overall, has experienced a dramatic slowdown in the rate of growth over the past several years – down from a high of 15.1% in 2003 to 3.5% in 2010, with a projection for 5.5% growth in 2013. The research report goes on to forecast a recovery to growth (driven largely by emerging rather than developed markets) at roughly half the levels prior to the economic crisis. Forecasters state that it is a dramatically different world out there, and medical technology companies need to focus in a way they never have before – industry dynamics are fundamentally changing.

However, the key is there is still growth and medical technology is still a huge industry – globally and in the United States.

According to statistics from AdvaMed, the Advanced Medical Technology Association, medical technology is one of America’s strongest and fastest-growing manufacturing sectors, creating nearly two million well-paying jobs across the United States. In addition, more than 6,000 companies in the United States create life-changing medical technology innovations.

As you see, the medical technology market as a whole is huge, but so are individual segments, so here is a closer look at some of them.

Joint Implant Market

Senior Industry Analyst at Frost & Sullivan, Aarti Shetty, shared her insights on the U.S. joint implant market, specifically hips and knees, with the hip market valued near $2.6 billion in 2012 and the knee market closing in on $3.5 billion in 2012.

A look at the joint implant market, regarding market drivers, shows that, “Technological advancements are transforming the orthopedic industry,” according to Shetty. “Technology is capable of significantly altering product acceptance, implant pricing, reimbursement rates, inpatient orthopedic utilization, and several other factors can directly or indirectly affect the joint reconstruction market.

“The economic slowdown negatively affected the number of procedures performed,” Shetty states, when asked to comment about the restraints which occurred in the joint implant market during the past few years. “People chose to live with pain over spending money for surgery if they could bear the pain, treating it more like an elective surgery. Now, with changes in the economy, the scenario is changing, but keeping costs low is a major trend in the overall healthcare market.”

When looking ahead five years, at the hip implant market alone, Shetty feels the following are hot areas. “Biomaterials are a growing interest in the market. Companies have developed patented technology in the materials market that claim to be more wear resistant, adding longevity to the implant, and these products sell at a premium.

“Price is becoming a huge factor in competitiveness in the hip implants market, and many manufacturing units are moving overseas to cut costs. Finally, minimally invasive surgery is slowly becoming the norm in hip replacement. The design requirements are different from the regular hip implants, so this opens up a market for smaller companies to enter. Traditionally, the market has high barriers to enter because large orthopedic giants dominate the market.”

When asked about the knee implant market – five years out – Shetty explains that, “Today’s patient population is more aware of the options available in the market for knee replacements. They are seeking best methods of treatment that can provide them with better surgery outcomes and optimum fit. It behooves manufacturers to cater to this growing demand of the population with custom designs, improved materials, and enhanced ease-of-use for surgeons. Advances in technology are likely to be a strong driving force for the market.”

According to Frost & Sullivan estimates, the revenue for the U.S. total disc arthroplasty market for the base year 2009 was $313.2 million. Expectations are to $910.7 million in 2016, at a compound annual growth rate (CAGR) of 16.5%, according to Shetty, who also talks about the drivers and restraints she sees in spinal surgery down the road.

Drivers

- Demographics bode well for growth in the non-fusion spinal surgery market

- Uncertainty in third-party reimbursements slows new product adoption rate

- Improved surgery outcomes and demonstrations encourage technology adoption

Restraints

- The risk of surgery affects acceptance of advanced spinal surgery procedures

- The disadvantage of spinal fusion spur the adoption of innovative, higher-cost, non-fusion technologies

- Lack of awareness about surgical options poses challenges to adoption

Global Orthopedics

Urbanowicz Consulting LLC Founder and President, Don Urbanowicz, spoke during the AMT – The Association For Manufacturing Technology Global Forecasting and Marketing Conference in October 2011 about the orthopedic market. Urbanowicz looked at the global market of orthopedics, stating that it is, “Facing a most challenging time, in which implant sales growth is proving to be increasingly difficult…because maturing markets, product commoditization, and steady price degradation have become a reality.

“In an effort to find new sources of growth and achieve cost savings, orthopedic companies have more aggressively pursued acquisitions,” Urbanowicz states.

However, one area strongly noted by Urbanowicz is the growth that will continue. He sees the hip market – dominated by five companies accounting for 90% of worldwide sales – growing 3% to 4% in 2012, worldwide, stating that the anterior approach procedure will gain traction with new product launches continuing.

Urbanowicz’s overview of knees highlights that patient-specific cutting blocks are gaining popularity, more than 50% of knee implants cases are on patients under the age of 65, and again, five companies account for, in this case, 95% of worldwide sales; with projections of 3% to 4% growth in 2012.

A slight more diversification shows in the spinal segment, with seven companies accounting for 80% of worldwide sales, and Urbanowicz sees another 3% to 4% growth for this sector in 2012 as well.

So Much More

Orthopedics is what seems to come to mind when people talk implants, but how about that crown you or a friend have? Perhaps you know someone with a stent or a CRM device. All fall under the vast medical technology market and all contribute, significantly.

Orthopedics is what seems to come to mind when people talk implants, but how about that crown you or a friend have? Perhaps you know someone with a stent or a CRM device. All fall under the vast medical technology market and all contribute, significantly.

BCC Research offers up a new report on the global markets for dental and consumable prosthetics, with an overall value worth $15.9 billion in 2010, and estimated to reach $18.5 billion by 2015, boasting a CAGR of 3.1% for their forecast period. The report states that the restorative and cosmetic supplies, materials, and prosthetics market accounts for the largest share of revenue in the total market driven by sales generated for crowns, bridges, and dental implants. This sector was valued at $9 billion in 2010, with an expected increase of 5.1% CAGR, putting it at $11.7 billion in 2015.

On the rise globally – whether through disease, congenital defects, or generalized degradation of logical function – is cardiac surgery. BCC Research offers a look at the cardiovascular devices market, forecasting growth. Overall sales in the global market for cardiovascular devices were nearly $84.6 billion in 2010, and by 2015, should increase to $97.3 billion, while the largest segment of this market, interventional cardiovascular devices, should rise to $74 billion in 2015. Forecasts for sales in diagnostic cardiovascular devices will rise to $16 billion in 2015, a CAGR of 2.6%.

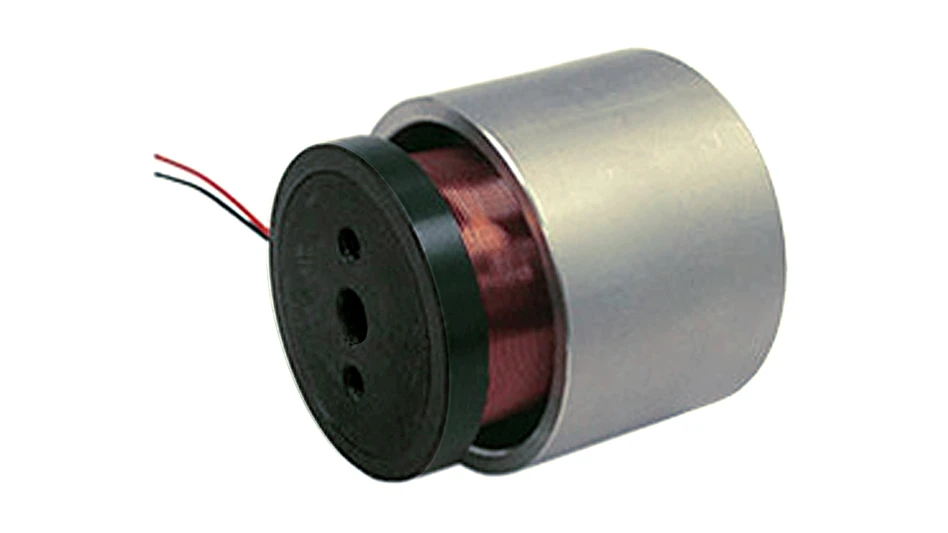

Winnowing in on just the United States is Bharatbook’s USA Cardiovascular Devices Market Trends and Forecast Report, putting the U.S. cardiovascular devices market at just more than $35 billion by 2015, showing a CAGR of approximately 7% from 2011 to 2015. According to analysts, the most rapidly growing segments in the cardiovascular devices market are interventional cardiology, cardiac rhythm management, and cardiovascular prosthetic device markets – with the cardiac rhythm management devices market one of the major contributing segments, expected to generate more than $16 billion by 2015. One of the fastest developing areas, interventional cardiology devices, looks to touch $12 billion by 2015. Contributing to this fast-growing market is the increased demand for minimally invasive surgeries amongst the rapidly aging population, enabling analysts to speculate a spark of further growth in the cardiovascular devices market.

Global We Go

Medical device outsourcing, contract manufacturing, whichever you prefer to call it, this market is booming! Global Industry Analysts (GIA) forecasts the global market for Medical Device Outsourcing to reach $44.7 billion by 2017. Primary drivers to this growth are medical device OEMs needing to reduce costs and accelerate time to market to ensure the commercialization of products efficiently and on time. The report notes the that strong growth in the medical device market, supported by the aging population, increased spending on healthcare, enhanced disease screening/detection techniques, development in minimally invasive therapies/diagnostics, and therapeutics, will echo downstream into the medical device outsourcing market.

So, as the worlds’ aging population and minimally invasive procedures continue to expand, all signs point to growth, showing that medical technology does not just shine in the United States, but is a beacon for worldwide growth amid rather uneasy economic times.

Explore the January February 2012 Issue

Check out more from this issue and find your next story to read.

Latest from Today's Medical Developments

- Stryker’s flexible syndesmotic fixation device stabilizes ankle injuries

- Mergers & acquisitions news: MGS, Quantum Surgical bolster medtech portfolios

- Exchangeable-head solid carbide cutting tools

- NextDent 300 MultiJet printer delivers a “Coming of Age for Digital Dentistry” at Evolution Dental Solutions

- Get recognized for bringing manufacturing back to North America

- Adaptive Coolant Flow improves energy efficiency

- VOLTAS opens coworking space for medical device manufacturers

- MEMS accelerometer for medical implants, wearables