Elizabeth Engler Modic Elizabeth Engler ModicEditor |

More than 1 billion smartphones shipped in 2013, according to research from market intelligence firm, International Data Corp. (IDC). Data from eMarketer shows the number of people, worldwide, using mobile phones is set to hit 4.55 billion this year, with nearly 40% of them using smartphones. Going hand-in-hand with smartphones are medical apps – mHealth – that enable people to manage their own health and wellness by receiving instant insight into their conditions. These apps also connect physicians to patients for real-time monitoring, as well as enabling people in remote places to gain information and receive input from a physician who could be hundreds, or even thousands of miles away. A recent report by Research2Guidance has the mHealth apps market valued at $26 billion by 2017. A report from PwC and GSMA looked at which industries will benefit from this growing market, with mobile operators expected as the key beneficiaries, commanding about 50% share, followed by device vendors (29%), content/application players (11%), and healthcare providers (10%). While I’m sure the increased use of smartphones and growth of mHealth apps is not surprising, it seems to me that this is yet another indication of how fast the medical market changes. In fact, the FDA is encouraging development of mobile medical apps that work to improve healthcare monitoring and provide consumers and healthcare professionals with vital information. With this market growing, the FDA knows it must exert oversight to ensure the safety and effectiveness of medical apps. So, back in September 2013, it issued the “Mobile Medical Applications Guidance for Industry and Food and Drug Administration Staff,” explaining how the FDA will apply the same risk-based approach used with medical devices in order to assure the safety and effectiveness of apps. Between the FDA weighing in on mHealth and mobile technology in full swing, the need that remains is true interoperability – the ability to create end-to-end solutions by interconnecting components and systems from multiple vendors forming a network. Vendors offering only closed end-to-end solutions will be shut out, and so will the devices that include these limited products. What does all this means for medical device designers? It’s all about staying one-step ahead with product development and knowing the right components to specify in a device. Planning true interoperability of a device – in terms of its ability to collect, connect, analyze, and share – requires collaboration. Sensors will be a large share of this activity. Just a glance at the latest product announcement from Sensirion underscores this market. There was no picture of the sensor; instead, a montage showed a jogger, walker, and person sitting on a park bench, all using devices that required sensors. Of course, Sensirion is not the only company positioning itself for the mHealth market and seeing the potential and growth, but it was the representation and capabilities that were highlighted which caught my attention. Designers don’t care what the sensor looks like. What matter is if it has the features required for the device they are designing, and if it integrates in a simple manner – as a truly open system should.

|

Explore the March 2014 Issue

Check out more from this issue and find your next story to read.

Latest from Today's Medical Developments

- Gore completes acquisition of Conformal Medical

- Medical textiles designed for cardiovascular, orthopedic, dental prosthetic applications

- Micro-precision 3D printing: Trends and breakthroughs in medical device manufacturing

- One-component, dual-cure adhesive system for medical device assembly

- #82 Manufacturing Matters - Forecasting 2026 with GIE Media's Manufacturing Group

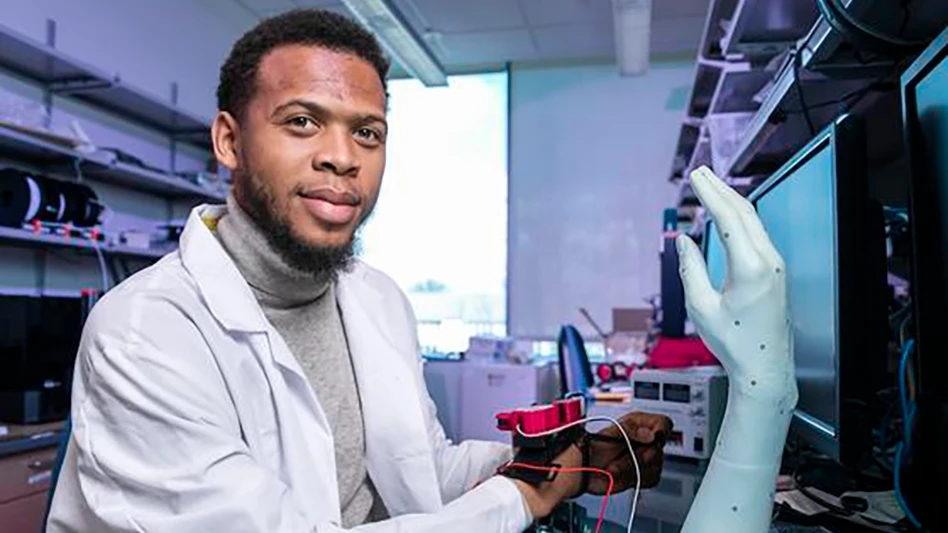

- Flexing prosthetic finger offers lifelike appearance and movement

- How the fast-evolving defense market impacts suppliers

- Medtronic’s Hugo robotic-assisted surgery system makes US debut