Crozet, Virginia – SmarTech Publishing offers deep dive market research report on the additive orthopedics industry, revealing an area of well-defined opportunity for additive manufacturing (AM) faced with sizeable change in the next several years.

From the report:

- As part of a greater opportunity in non-dental medical 3D printing opportunities, the additive orthopedics segment is expected to drive an estimated 44% of all medical 3DP revenues today, and will continue to grow as the single largest area of medical 3DP throughout the forecast period to over 60% of all associated revenues

- Production of all additively manufactured orthopedic and medical implants is estimated to grow by 29% CAGR through 2026, with the fastest growing segments being components of knee reconstruction systems, spinal fusion devices, and non-load-bearing extremity fracture devices greatly exceeding total average growth

- Associated revenue opportunities in additive orthopedics heavily favor outsourced manufacturing and engineering services, as outsourced production of printed implants will remain common through both contract manufacturers for standard sized implants and direct-to-provider services for patient specific implants

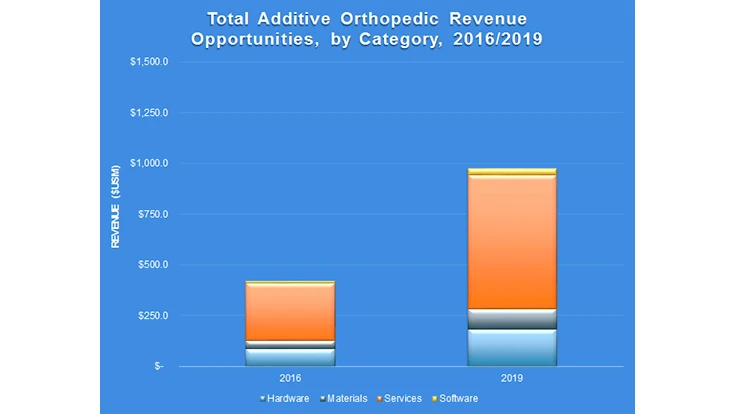

Additive manufacturing technologies have been employed by orthopedic device manufacturers for the production of approved medical implants for almost a decade, however the use of such technology is at a critical tipping point today. SmarTech’s proprietary market models have been adapted to this growing serial manufacturing opportunity as part of its ongoing analysis plan in biomedical 3D printing/additive manufacturing, revealing that the additive orthopedic market generated nearly $500 million in total opportunities in 2016.

Use of additive manufacturing technologies for the production of approved orthopedic devices has been a driving force in the growth of metal AM to address true serial manufacturing applications. Today, the industry is rapidly expanding these efforts to include not only titanium implants in new orthopedic care segments, but also the use of polymer and bioactive materials and 3D printing technologies to revolutionize the future of orthopedic care using implantable devices.

This new study, the first ever to provide an in-depth and dedicated opportunity analysis specific to the use of AM/3DP technology to produce implants, seeks to provide an industry-standard segmentation of the additive orthopedic market while also quantifying specific revenue generation opportunities. With nearly 100 pages of analysis and market data, “Additive Orthopedics: Markets for 3D Printed Medical Implants 2017” is meant to provide the orthopedic industry with a complete guide to current and future areas of adoption and growth. The associated market forecasts included in this report detail:

- Specific revenue generation opportunities resulting from the use of AM/3DP for orthopedic applications, encompassing the sale of AM/3DP hardware, print materials, print software, and outsourced production and clinical engineering services

- Hardware unit sales to support additive orthopedic production in unit sales, installations, and revenue, by print technology

- Implant production volumes and forecast projections for major segments of orthopedic care including knee, hip, spine, cranial and facial, and extremities

In addition to forecast data, this report also provides a logical segmentation of the market by examining the value proposition for various additive technologies in the context of implants and various device types. A complete trailing twelve-month industry activity review in additive orthopedics, as well as an analysis of emerging implant research for new 3D printable applications in regenerative implants using materials such as calcium phosphate and polymer printing is also included.