CREDIT: AdobeStock_280441360

Arcline Investment Management, a growth-oriented private equity firm, has entered into a definitive agreement to sell its portfolio company Medical Manufacturing Technologies, to Perimeter Solutions Inc. for $685 million.

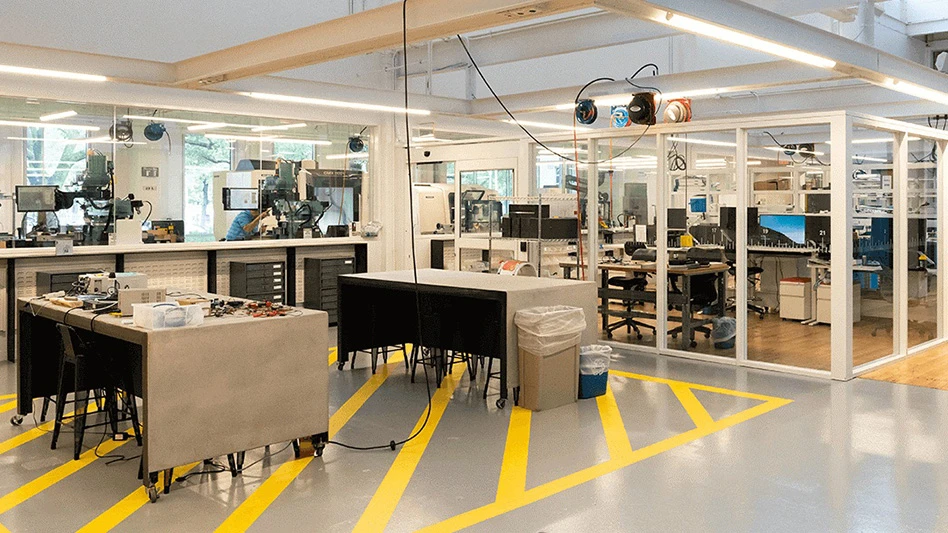

Based in Charlotte, North Carolina, MMT is a leading global provider of medical device manufacturing solutions, serving as a single-resource partner for automated, process-driven medical manufacturing. The company supports more than 1,000 customers – including many of the world's leading medical technology OEMs and CDMOs – in the production of complex interventional medical devices such as catheters, guidewires, stents, microcoils, and related components. With more than 350 employees and 14 production facilities, MMT is a critical partner to customers operating in precision-dependent and highly regulated environments.

Since acquiring MMT in 2020, Arcline has executed a disciplined strategy to build a scaled provider of mission-critical manufacturing technologies for medical device OEMs and CDMOs. The firm significantly grew the company's revenue and EBITDA and completed 13 targeted acquisitions that broadened MMT's capabilities, including automation solutions and specialty manufacturing services that simplify and optimize complex production processes. Arcline thanks Chief Executive Officer Robbie Atkinson and the entire MMT team for their partnership.

The transaction is expected to close in the first quarter of 2026, subject to regulatory approvals and customary closing conditions.

William Blair and Houlihan Lokey served as financial advisors, and Kirkland & Ellis LLP and Fredrikson & Byron P.A. served as legal advisors to Arcline in connection with the transaction.

Latest from Today's Medical Developments

- Hohenstein Medical debuts enhanced medical device testing capabilities

- Arterex unveils unified brand identity

- Dymax demonstrates light-curing material solutions for medical devices

- Able Medical Devices showcases latest sternal closure solutions

- TMTS 2026 explores AI-powered sustainable manufacturing and more

- QT9 QMS platform streamlines quality management, compliance for medical device manufacturers

- Spineology releases patient-specific expandable spinal implant

- Nordson EFD to demonstrate medical assembly automation applications