Compass Diversified Holdings, an owner of leading middle market businesses, announced that on March 5, 2012, it entered into an agreement to acquire and consummated the acquisition of Arnold Magnetic Technologies Holdings Corporation.

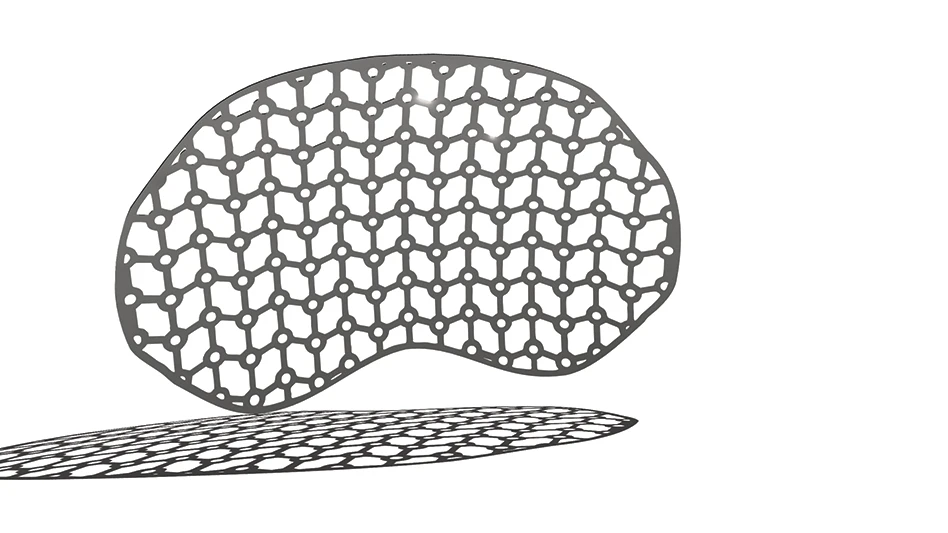

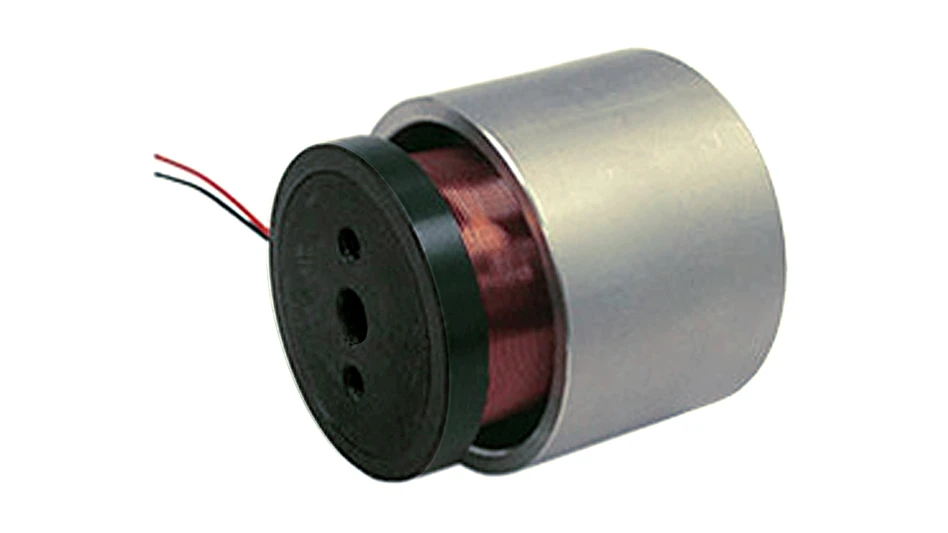

Based in Rochester, NY with an operating history of more than 100 years, Arnold is a leading global manufacturer of engineered magnetic solutions for a wide range of specialty applications and end-markets, including energy, medical, aerospace and defense, oil and gas exploration, advertising, general industrial and automotive. From its manufacturing facilities located in the United States, the United Kingdom, Switzerland, and China, the company produces engineered magnetic assemblies in addition to high performance permanent magnets, flexible magnets, and precision foil products that are mission critical in motors, generators, sensors and other systems and components. Based on its long-term relationships, the company has built a diverse and blue-chip customer base totaling more than 2,000 clients worldwide. For the year ended December 31, 2011, Arnold reported revenue of approximately $135.8 million.

Basis for the purchase price for Arnold of $130.5 million was on a total enterprise value of $124.2 million and included $6.3 million of cash and working capital adjustments. Arnold generated approximately $17.9 million of adjusted EBITDA for fiscal 2011. Acquisition related costs were approximately $4.2 million. CODI funded the acquisition through available cash on its balance sheet and a draw of $25.0 million on its revolving credit facility.

CODI's initial common equity ownership in Arnold, as a result of the transaction, is approximately 96.7% on a primary basis. In addition to its equity investment in Arnold, CODI provided loans totaling $85.5 million to Arnold as part of the transaction. Arnold's management invested alongside CODI and owns the remaining approximate 3.3%.

Commenting on the acquisition, Alan Offenberg, CEO of CODI, says, "We are pleased to take advantage of our balance sheet strength and expand our family of niche leading businesses with the acquisition of Arnold. This acquisition is consistent with our philosophy of owning companies with a real reason to exist based on Arnold's strong and defensible market position, diversified customer base, stable cash flow, experienced management, and attractive growth prospects. The company's superior reputation as a global manufacturer of highly engineered, application-specific magnet solutions is reflected in its longstanding history of more than 100 years and extensive client relationships across various end-markets. We are excited about the favorable dynamics in the rare earth magnet industry, including increasing demand from high-growth sectors such as alternative energy. We look forward to working closely with management to capitalize on the positive macro-trends and leverage Arnold's engineering and product development capabilities to accelerate the company's growth potential."

Offenberg adds, "This platform acquisition, our fourth in the past two years, increases the current number of businesses we own to nine. Going forward, we will maintain our focus on utilizing CODI's significant liquidity to capitalize on additional acquisitions at favorable valuations and terms as we have in the past."

Tim Wilson, chief executive officer, Arnold, will continue to serve in the same capacity at the company.

Wilson comments, "CODI's acquisition of Arnold provides compelling opportunities to expand our business. By drawing upon CODI's parent-level financing structure and success in growing niche market leaders, we will enhance our ability to implement strategic growth initiatives aimed at further strengthening our global leadership in the specialty and rare earth magnetic industry for the benefit of our stakeholders."

Latest from Today's Medical Developments

- Stryker’s flexible syndesmotic fixation device stabilizes ankle injuries

- Mergers & acquisitions news: MGS, Quantum Surgical bolster medtech portfolios

- Exchangeable-head solid carbide cutting tools

- NextDent 300 MultiJet printer delivers a “Coming of Age for Digital Dentistry” at Evolution Dental Solutions

- Get recognized for bringing manufacturing back to North America

- Adaptive Coolant Flow improves energy efficiency

- VOLTAS opens coworking space for medical device manufacturers

- MEMS accelerometer for medical implants, wearables