Bethesda, Maryland – A Capital One survey found that 41% of U.S. healthcare industry leaders expect mergers and acquisition transactions to be their preferred growth strategy for 2016, outpacing organic growth through revitalizing and updating existing offerings (35%). In addition, 95% of respondents expect their businesses to deliver financial performance in 2016 that equals or exceeds results from the past year. Capital One conducted the survey shortly before the J.P. Morgan 34th Annual Healthcare Conference, which was held Jan, 11-14 in San Francisco.

This third annual survey of senior healthcare professionals found enduring optimism for the healthcare industry, although at lower levels than previous years. Sixty percent of respondents anticipate stronger performance from their businesses in 2016, while 35% expect performance that equals 2015 results. Only 5% anticipate weaker financial performance this year. By comparison, 77% of professionals surveyed in 2014 expected to see stronger industry performance in upcoming years, and 68% expected similar industry growth in 2015. Both prior surveys were conducted by the lending business of GE Capital, Healthcare Financial Services, which was acquired by Capital One on Dec. 1, 2015.

Access to capital will continue to be a priority in the healthcare industry; 89% of respondents expect their capital needs will be the same or higher this year.

“2016 should be another dynamic year for the healthcare industry as we expect to see further consolidation and deal making activity,” said Darren Alcus, President, Capital One Healthcare. “We see new opportunities to support clients with financial solutions as they adapt and grow in this evolving market.”

Implementing the Affordable Care Act (ACA) remains the greatest challenge facing the healthcare industry, according to 33% of respondents – a decrease of 10 percentage points from the 2015 survey. Regulatory scrutiny (32%) and the U.S. economy (16%) were seen as the second- and third-greatest challenges facing the healthcare industry. Respondents were split on the expected impact of the ACA in 2016, with 38% anticipating no benefit from the law and 36% saying they will benefit.

The Capital One survey asked professionals about their industry and company outlook for 2016. Respondents included more than 250 senior executives from healthcare companies, including pharmaceutical, healthcare IT and medical technology companies, hospitals, healthcare service providers and health systems, as well as other industry participants.

Capital One Healthcare is a leading provider of financial services to the industry. Customers across healthcare sectors – including long term care, pharmaceuticals, medical devices, hospitals and outpatient services, healthcare IT, medical properties and life sciences – rely on Capital One Healthcare to finance acquisitions, refinance existing debt, support working capital needs and fund growth initiatives. With in-depth expertise, our team of professionals creates solutions tailored to meet the needs of our customers.

Capital One Healthcare is a part of Capital One Commercial Banking, which leverages a relationship-based banking model that seamlessly delivers an array of products and services including loans and deposit accounts, treasury management services, merchant services, investment banking, international services and correspondent banking.

Source: Capital One Financial Corp.

Latest from Today's Medical Developments

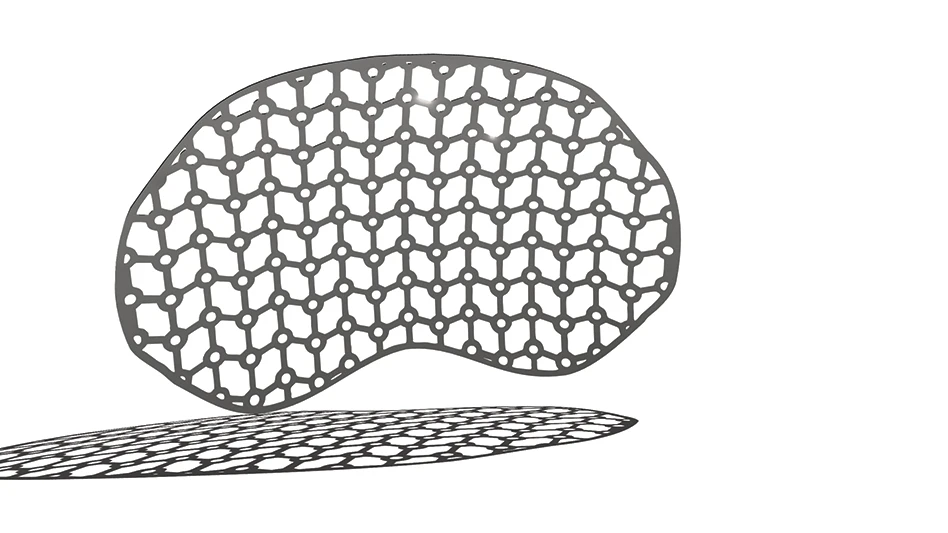

- Stryker’s flexible syndesmotic fixation device stabilizes ankle injuries

- Mergers & acquisitions news: MGS, Quantum Surgical bolster medtech portfolios

- Exchangeable-head solid carbide cutting tools

- NextDent 300 MultiJet printer delivers a “Coming of Age for Digital Dentistry” at Evolution Dental Solutions

- Get recognized for bringing manufacturing back to North America

- Adaptive Coolant Flow improves energy efficiency

- VOLTAS opens coworking space for medical device manufacturers

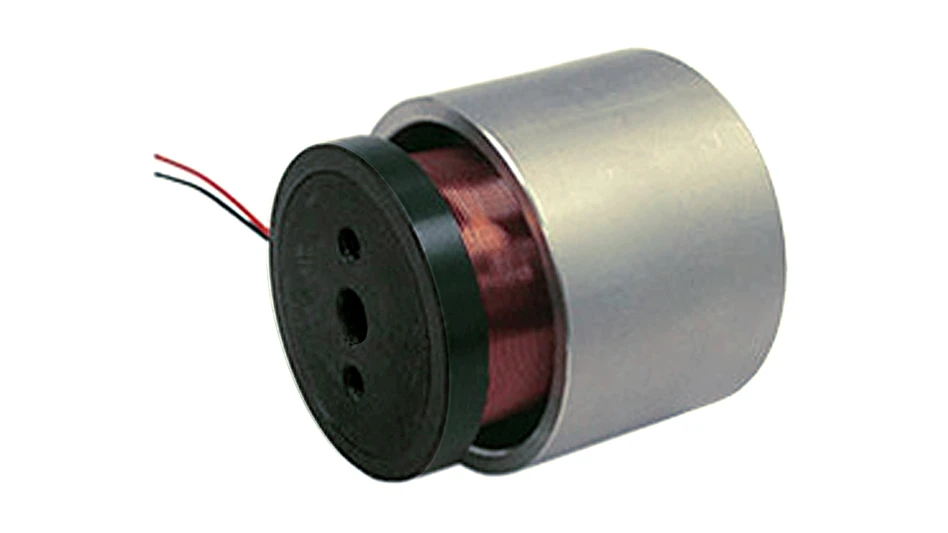

- MEMS accelerometer for medical implants, wearables