Charlotte, North Carolina – Officials from Commercial Credit Group Inc. (CCG), a leading independent commercial equipment finance company, announced the purchase of the machine tool finance business of Manufacturers Capital LLC., thus expanding into the machine tool and manufacturing industry. With the closing of the transaction, the Manufacturers Capital team will operate as a division of CCG and will continue to provide outstanding service to the machine tool and manufacturing industries.

“The acquisition of Manufacturers Capital, an independent, industry leader, allows us to expand into a new, yet similarly structured market to our existing business, led by a very accomplished group of professionals,” notes CCG Co-founder and CEO, Dan McDonough. “Many senior managers of CCG have previously worked with Mr. Goose and the Manufacturers Capital team and I cannot think of a better cultural fit to further enhance our growth opportunities.”

“CCG’s significant funding capabilities and operating scale enable us to enhance our industry-leading customer experience by offering an extensive selection of financing options. The similarities in our cultures and senior management provide for a seamless transition to our new partner. The entire Manufacturers Capital team is excited to become part of the CCG family,” says Senior Vice President, David Goose.

Manufacturers Capital provides commercial loans and leases for machine tool and fabrication equipment to manufacturing companies located throughout the United States. The Manufacturers Capital team uses its knowledge of the machine tool market to develop close relationships with equipment vendors in order to deliver custom tailored finance solutions to end-user manufacturing customers.

About Commercial Credit Group Inc.

Commercial Credit Group Inc., a wholly owned subsidiary of Commercial Credit, Inc. is an independent, commercial equipment finance company that provides secured loans and leases to small and mid-sized businesses in the construction, fleet transportation, machine tool and manufacturing and waste industries. The company’s sales force is located throughout North America and sources transactions through end-users, equipment vendors and manufacturers with typical transaction sizes ranging from $100,000 to $2,500,000. Since its inception in 2004, CCG has originated approximately $3.0 billion of finance receivables. CCG is headquartered in Charlotte, North Carolina, and operates full service offices in Buffalo, New York, and Naperville, Illinois. CCG Equipment Finance Limited services the Canadian Provinces of Ontario, west to British Columbia, from its Canadian headquarters in Hamilton, Ontario.

Source: CCG

Latest from Today's Medical Developments

- Gore completes acquisition of Conformal Medical

- Medical textiles designed for cardiovascular, orthopedic, dental prosthetic applications

- Micro-precision 3D printing: Trends and breakthroughs in medical device manufacturing

- One-component, dual-cure adhesive system for medical device assembly

- #82 Manufacturing Matters - Forecasting 2026 with GIE Media's Manufacturing Group

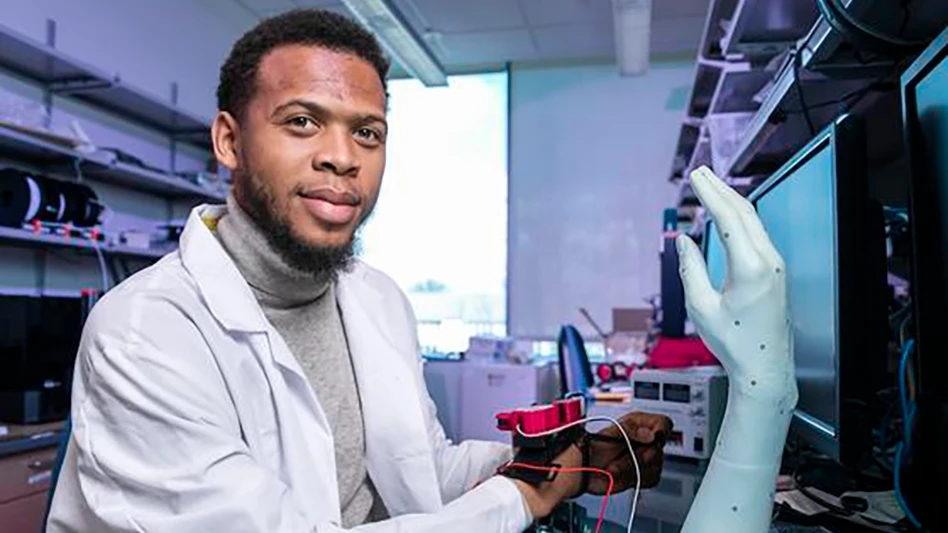

- Flexing prosthetic finger offers lifelike appearance and movement

- How the fast-evolving defense market impacts suppliers

- Medtronic’s Hugo robotic-assisted surgery system makes US debut