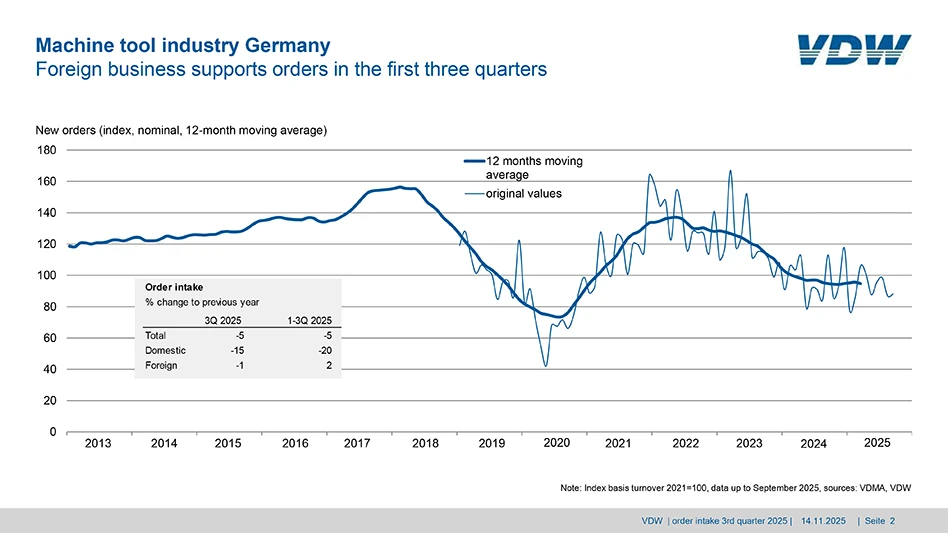

CREDIT: VDW

Orders received by the German machine tool industry fell by 5% in the third quarter of 2025. Domestic orders were down by 15%, while orders from abroad decreased slightly by 1%. Orders also fell by 5% in the period from January to September 2025. Domestic demand declined by 20%, while foreign orders stabilized at 2% higher than in the previous year.

"We are currently seeing sideways movements in the incoming orders, leading us to assume that the decline has now bottomed out at a low level," says Dr. Markus Heering, executive director of the VDW (German Machine Tool Builders' Association) in Frankfurt am Main, commenting on the result. The orders that are currently being placed, particularly those from abroad, are in the fields of automation, digitalization, service, retrofitting and sustainability. It is mainly customers from the defense, aviation, and medical technology industries who are investing. The defense sector is expanding its capacities in response to the high levels of demand. This benefits not only the suppliers of electronics, metal and precision components but also the engineering sector. Nevertheless, it will be several months before these orders feed through into the production figures. Meanwhile, key customer sectors, including the automotive and supplier industries, remain weak.

In regional terms, the Europe market is currently holding up well, particularly Turkey, Italy, Spain, and Eastern Europe – especially the Czech Republic, Poland, and Hungary. By contrast, other important markets such as China, South Korea, the U.S., and Mexico are showing signs of slowing down.

"The very slow pace of reform here in Germany combined with the ongoing uncertainty in the global economy caused by U.S. tariffs are continuing to hold back domestic investment," says Heering. Further factors which are weighing on demand include structural change in the automotive industry, ongoing competition with Asian manufacturers, and currency-related headwinds which have seen the euro appreciate against the U.S. dollar and yen.

Sales of machine tools were down 7% in the first nine months of this year. If the announced investments in defense and infrastructure come to fruition, this will enable Europe – and Germany in particular – to develop into a positive driving force within the global economy in the coming year instead of holding it back.

Latest from Today's Medical Developments

- Ilika, Cirtec advance strategic partnership to commercial level

- Engineered fluids offer full lifecycle solutions for medical device development

- Syringe-less injector system for diagnostic imaging obtains fourth FDA clearance

- Hohenstein Medical debuts enhanced medical device testing capabilities

- Arterex unveils unified brand identity

- Dymax demonstrates light-curing material solutions for medical devices

- Able Medical Devices showcases latest sternal closure solutions

- TMTS 2026 explores AI-powered sustainable manufacturing and more