CREDIT: VDW

Orders received by the German machine tool industry in the third quarter of 2024 were 16% down on the same period last year. Orders from Germany fell by 17% whereas those from abroad dropped by 15%. Orders received in the first three quarters of 2024 were 23% down on the same period last year. Domestic orders were 10% lower. Orders from abroad were 28% below the previous year's figure.

"The order situation remains challenging," says Dr. Markus Heering, executive director of the VDW (German Machine Tool Builders' Association) in Frankfurt am Main, commenting on the result.

German industry performed comparatively well in the first nine months of the year, supported by a number of major individual projects.

In general, however, domestic customers are very unsettled and are unwilling to invest," Heering says. This is dragging down the domestic European market as a whole, as Germany is the most important trading partner for many countries. The other “triad” regions have also lost ground. Asia is most badly affected due to the weak demand from China. There is still no improve-ment in sight here. The smallest decline has been posted in America. The US and Mexico in particular have propped up demand.

"We have seen little change in the state of the industry since the first half of the year," Heering says. "The stream of news coming from the automotive industry is giving cause for concern. And overall business levels are down across the board, both in the markets and in the customer industries. A number of major projects from the aerospace, medical technology, energy, shipbuilding and defense sectors are helping."

Outperforming the new machine business at present are services, components, repairs, maintenance and conversions. Automation remains a key driver of machine tool investment in the sector.

According to association surveys, significantly more machine tool manufacturers are planning to reintroduce short-time working in the near future. 35% of respondents were considering this in the second quarter, with the figure rising to 45% in the third quarter. There are also plans to reduce the numbers of temporary workers. At the end of the first half of the year, the sector employed around 65,250 people.

The production forecast for the year as a whole remains unchanged: a decline of 8%.

Background

The German machine tool industry ranks among the five largest specialist groupings in the mechanical engineering sector. It provides production technology for metalworking applications in all branches of industry and makes a crucial contribution towards innovation and enhanced productivity in the industrial sector as a whole. Due to its absolutely key role for industrial production, its development is an important indicator for the economic dynamism of the industrial sector as such. In 2023, with an average of 65,300 employees (firms with more than 50 staff), the sector produced machines and services worth around 15.4 billion euros.

Latest from Today's Medical Developments

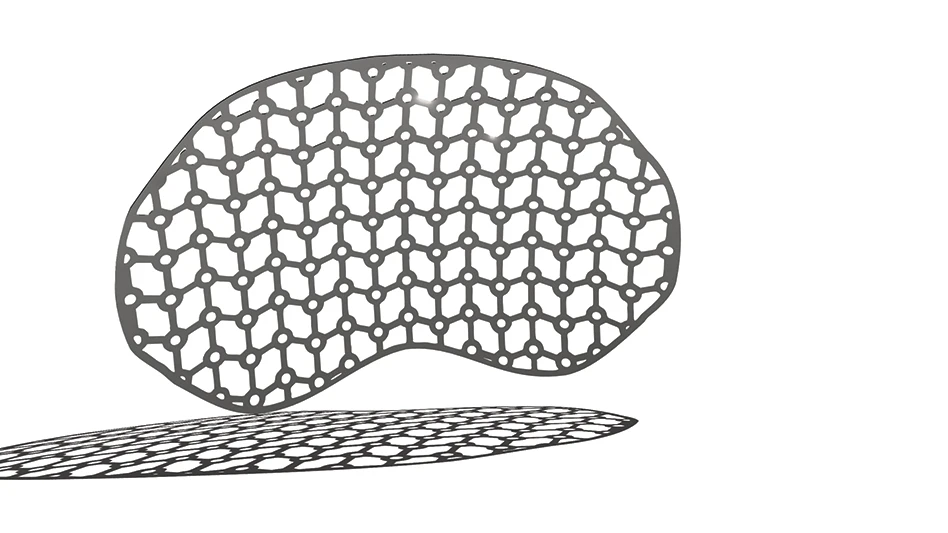

- Stryker’s flexible syndesmotic fixation device stabilizes ankle injuries

- Mergers & acquisitions news: MGS, Quantum Surgical bolster medtech portfolios

- Exchangeable-head solid carbide cutting tools

- NextDent 300 MultiJet printer delivers a “Coming of Age for Digital Dentistry” at Evolution Dental Solutions

- Get recognized for bringing manufacturing back to North America

- Adaptive Coolant Flow improves energy efficiency

- VOLTAS opens coworking space for medical device manufacturers

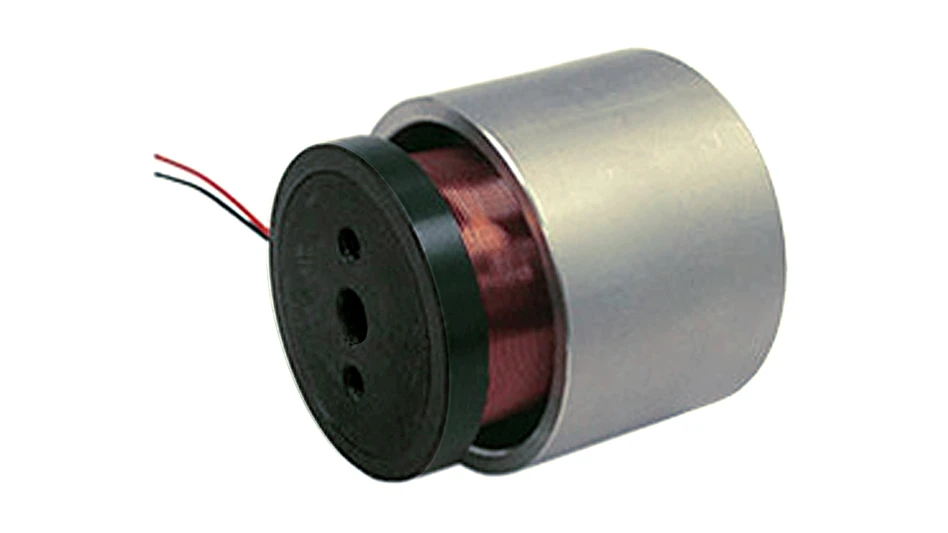

- MEMS accelerometer for medical implants, wearables