The global sales of drug-eluting balloons (DEBs) across the 10 major markets are expected to witness a significant increase over the coming years, from $164 million in 2012 to $477 million in 2019, at a compound annual growth rate (CAGR) of 16%, following the product’s launch in the U.S. and Japanese markets, according to a new report from research and consulting firm GlobalData.

The company’s latest report* states that by 2019, the US, UK, France, Germany, Italy, Spain and Japan will account for approximately 70% of the DEB market for coronary artery disease (CAD) and peripheral artery disease (PAD) in the lower extremity. Among the 10 countries covered in the report, the US is forecast to boast the largest share in the DEB market, with 26% by 2019.

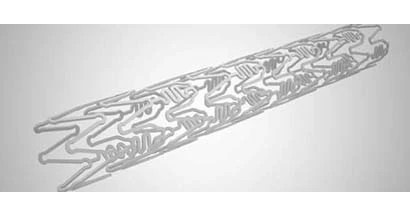

The demand for effective therapies targeting indications such as in-stent restenosis and complex lesions, and reducing complications associated with drug-eluting stenting (DES), will be primary drivers behind the market growth. Downstream cost-saving measures are also expected to contribute, along with an increasing prevalence in CAD and PAD.

Priya Madhavan, GlobalData’s analyst covering Cardiovascular Devices, says: “The DEB market is a dynamic one, where the technology has the potential to be an alternative therapy option for patients suffering from CAD and PAD. DEB can be utilized for select coronary and peripheral indications, including for patients who are not eligible for DES, and we expect this to expand the market over the coming years by targeting challenging patient populations.”

Despite the anticipated level of DEB market growth by 2019, GlobalData also expects a number of barriers to prevent any further increase in revenue.

These include a lack of clinical data, as well as numerous reimbursement issues. The fact that DEBs are not reimbursed in the public healthcare system in countries such as France, Brazil, and India means that adoption of the technology among these countries is slow. The high selling price and regulatory challenges surrounding DEBs are also proving a hindrance to their take-up.

Madhavan continues: “Physicians and regulatory authorities want to see long-term clinical data that demonstrate the superiority of DEB angioplasty when compared with stenting.

“Comparative studies looking at the efficacy of different DEB products are essential for developing therapies that improve patient outcomes, and robust clinical data will assist DEBs in receiving approval from the US Food and Drug Association (FDA) and Japanese Pharmaceuticals Medical Devices Agency (PMDA) in order to launch within these markets,” Madhavan says.

Source: GlobalData

Latest from Today's Medical Developments

- Exchangeable-head solid carbide cutting tools

- NextDent 300 MultiJet printer delivers a “Coming of Age for Digital Dentistry” at Evolution Dental Solutions

- Get recognized for bringing manufacturing back to North America

- Adaptive Coolant Flow improves energy efficiency

- VOLTAS opens coworking space for medical device manufacturers

- MEMS accelerometer for medical implants, wearables

- The compact, complex capabilities of photochemical etching

- Moticont introduces compact, linear voice coil motor