The Equipment Leasing & Finance Foundation (the Foundation) released the February 2012 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI). Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $628 billion equipment finance sector. Overall, confidence in the equipment finance market is 59.6, up slightly from the January index of 59.0, indicating industry participants’ optimism is steady despite a cautious outlook about the global economic situation in the coming months.

February 2012 Survey Results:

The overall MCI-EFI is 59.6, an increase from the January index of 59.0.

- When asked to assess their business conditions over the next four months, 23.5% of executives responding said they believe business conditions will improve over the next four months, up from 18.4% in January. 73.5% of respondents believe business conditions will remain the same over the next four months, down from 76.3% in January. 2.9% of executives believe business conditions will worsen, a decrease from 5.3% in January.

- 26.5% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, an increase from 18.4% in January. 67.6% believe demand will “remain the same” during the same four-month time period, down from 76.3% the previous month. 5.9% believe demand will decline, up from 5.3% who believed so in January.

- 20.6% of executives expect more access to capital to fund equipment acquisitions over the next four months, down from 21.1% in January. 79.4% of survey respondents indicate they expect the “same” access to capital to fund business, an increase from 78.9% the previous month. No survey respondents expect “less” access to capital, unchanged from January.

- When asked, 26.5% of the executives reported they expect to hire more employees over the next four months, down from 31.6% in January. 70.6% expect no change in headcount over the next four months, an increase from 63.2% last month, while 2.9% expect fewer employees, down from 5.3% in January.

- 91.2% of the leadership evaluates the current U.S. economy as “fair,” up from 89.5% last month. 8.8% rate it as “poor,” an improvement from 10.5% in January.

- 26.5% of survey respondents believe that U.S. economic conditions will get “better” over the next six months, up from 21.1% in January. 70.6% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, down from 78.9% in January. 2.9% responded that they believe economic conditions in the U.S. will worsen over the next six months, an increase from no one who believed so last month.

- In February, 26.5% of respondents indicate they believe their company will increase spending on business development activities during the next six months, down from 34.2% in January. 73.5% believe there will be “no change” in business development spending, up from 65.8% last month, and no one believes there will be a decrease in spending, unchanged from last month.

Latest from Today's Medical Developments

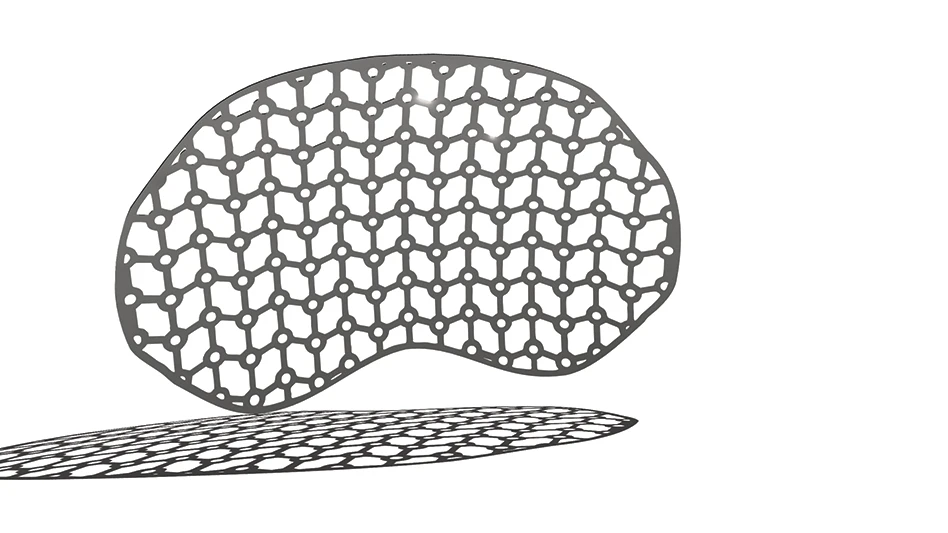

- Stryker’s flexible syndesmotic fixation device stabilizes ankle injuries

- Mergers & acquisitions news: MGS, Quantum Surgical bolster medtech portfolios

- Exchangeable-head solid carbide cutting tools

- NextDent 300 MultiJet printer delivers a “Coming of Age for Digital Dentistry” at Evolution Dental Solutions

- Get recognized for bringing manufacturing back to North America

- Adaptive Coolant Flow improves energy efficiency

- VOLTAS opens coworking space for medical device manufacturers

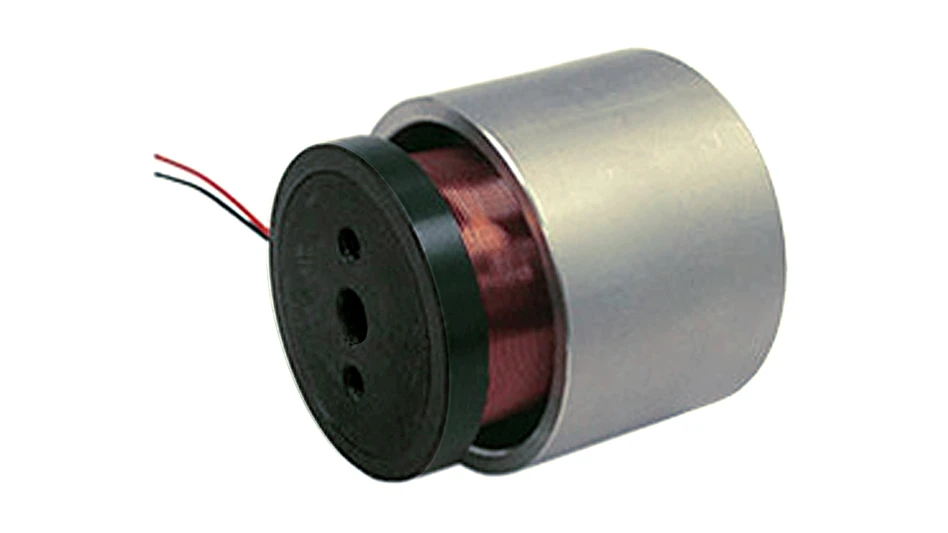

- MEMS accelerometer for medical implants, wearables