The global market for X-ray equipment used for medical, dental, veterinary applications, and other purposes expanded to more than $10 billion in 2012, and is set to rise by 18% to reach $12 billion in 2017.

Growth will be driven by the continued digitalization of X-ray systems and increasing healthcare investment in emerging regions, according to the Medical Service at IMS Research, now part of IHS Inc., a leading global source of critical information and insight.

The attached figures present the forecast of global X-ray equipment revenue from 2012 to 2017 and the penetration of digital technology in the various segments of the market in 2012.

The global X-ray market includes the following product categories: general radiography, fluoroscopy, mammography, interventional, mobile c-arm, veterinary, and dental.

“General radiography is undergoing a major transition away from film and toward digital flat-panel detector (FPD) technology, with more affordable solutions such as retrofit kits driving this migration in many cash-strapped regions,” says Sarah Jones, analyst for medical electronics at IHS. “Shipments of FPD and retrofit FPD systems accounted for an estimated 15% of annual general radiography shipments in 2012. That total is expected to rise to 25% in 2017.”

The mammography market is already dominated by FPD full-field digital mammography (FPD-FFDM) equipment, led by adoption in mature regions. In contrast, FPD-FFDM uptake in emerging regions is relatively low, with few healthcare providers able to purchase the costly equipment and demand for breast screening being very low.

Meanwhile, interventional and mobile C-arm equipment is benefitting from a growing trend toward minimally invasive surgery. Minimally invasive surgery reduces patient hospital stays and increases patient throughput.

More advanced systems with digital technology and advanced navigation software is driving growth in mobile C-arm X-ray. Interventional X-ay is already dominated by digital technology and is being spurred by new installations of hybrid operating hybrid operating rooms that combine multiple imaging modalities and full surgical equipment in one room.

Hospitals, for their part, are becoming more receptive to new procedures like transcatheter aortic valve implantation (TAVI), with the use of medical imaging as an alternative to open-heart surgery. These procedures now are being performed using high-end mobile C-arm X-ray equipment, requiring FPD technology.

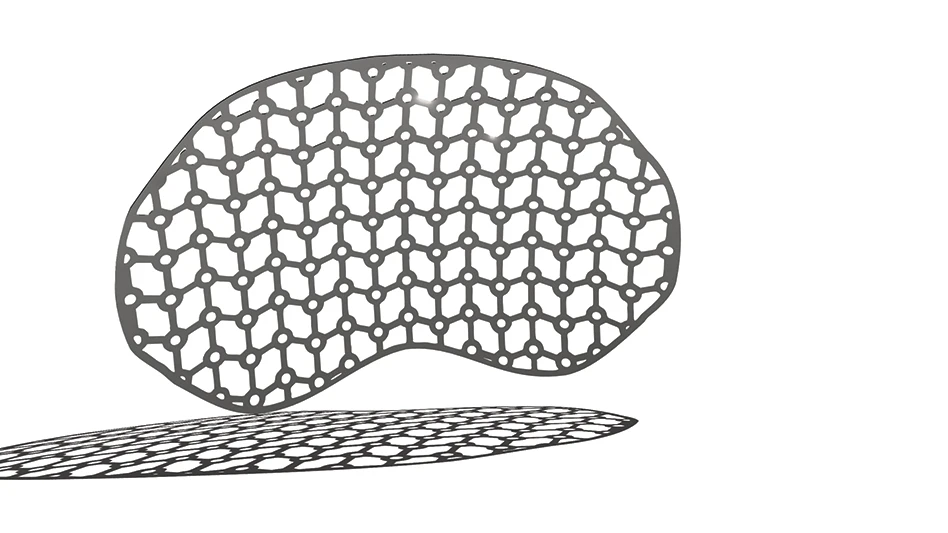

Veterinary X-ray is also seeing a transition to digital FPD technology in developed regions, with existing analog systems now being replaced by CR and FPD X-ray equipment. Wireless FPD panel usage is likewise increasing in the equine veterinary market, and fixed equipment is increasingly used in smaller animal practices.

The dental X-ray segment currently is dominated by analog film. However, a major shift to digital sensors and photo-stimulable phosphor (PSP) imaging is occurring. Extraoral imaging is also increasing in popularity, with more complementary metal–oxide–semiconductor (CMOS)-based FPD detectors being used.

Challenging global economic conditions have significantly impacted the X-ray market. In the short term, delayed purchasing and slower demand are predicted to continue. However, hard times are also creating an opportunity for lower-cost digital solutions, such as retrofit FPD panels/kits, to penetrate the market. This is because such products offer viable, low-cost stopgap solutions for healthcare providers affected by spending cuts.

Over the longer term, the global X-ray market is forecast to recover. Emerging regions will be the main market drivers, particularly in China, India, Latin America and parts of Southeast Asia. FPD also will become the most common technology type, due to increased efficiency, image quality and lower lifetime cost of ownership.

Moreover, the continued digitization of healthcare will sustain demand for digital X-ray, with FPD X-ray systems globally forecast to grow the fastest out of all product types.

Latest from Today's Medical Developments

- Stryker’s flexible syndesmotic fixation device stabilizes ankle injuries

- Mergers & acquisitions news: MGS, Quantum Surgical bolster medtech portfolios

- Exchangeable-head solid carbide cutting tools

- NextDent 300 MultiJet printer delivers a “Coming of Age for Digital Dentistry” at Evolution Dental Solutions

- Get recognized for bringing manufacturing back to North America

- Adaptive Coolant Flow improves energy efficiency

- VOLTAS opens coworking space for medical device manufacturers

- MEMS accelerometer for medical implants, wearables