According to Millennium Research Group (MRG), the global authority on medical technology market intelligence, the mature and largely commoditized United States market for gynecological devices will grow moderately to reach a value of nearly $984 million by 2017. A significant driver of market growth is the increasing number of gynecological procedures performed in an office setting.

Manufacturers have increasingly focused on implementing promotional and training initiatives catering to physicians performing gynecological procedures in the office setting. Driving this shift in where procedures are performed is the increased patient comfort in an office environment, as well as the rising popularity of minimally invasive procedures, which are easily performed in physicians’ offices. As a result, procedures such as global endometrial ablation (GEA) and transcervical female sterilization are increasingly being performed in the office setting, also leading to a higher overall number of procedures. For example, Conceptus created a direct-to-consumer campaign targeted at women using traditional birth control measures to educate them on the transcervical sterilization option, available as an office procedure.

The US gynecological device market does face challenges that may hinder growth. It is a mature market, dominated by several large manufacturers, including Hologic, Ethicon, Conceptus, and Boston Scientific, that often compete in multiple segments. Several of the products available in this market are commoditized products with little differentiation that have to compete on price, causing companies to focus on brand recognition in their marketing. Newer or smaller competitors find it difficult to gain a foothold in the market.

“The lingering effects of the economic downturn will also negatively affect the market,” says MRG Analyst Jennifer Smith. “Patients will put off elective procedures, particularly expensive ones like in vitro fertilization (IVF), and facilities will delay the purchase of costly capital equipment such as colposcopes or hysteroscopes. Nevertheless, positive factors will lead to overall growth in this market.”

Latest from Today's Medical Developments

- Gore completes acquisition of Conformal Medical

- Medical textiles designed for cardiovascular, orthopedic, dental prosthetic applications

- Micro-precision 3D printing: Trends and breakthroughs in medical device manufacturing

- One-component, dual-cure adhesive system for medical device assembly

- #82 Manufacturing Matters - Forecasting 2026 with GIE Media's Manufacturing Group

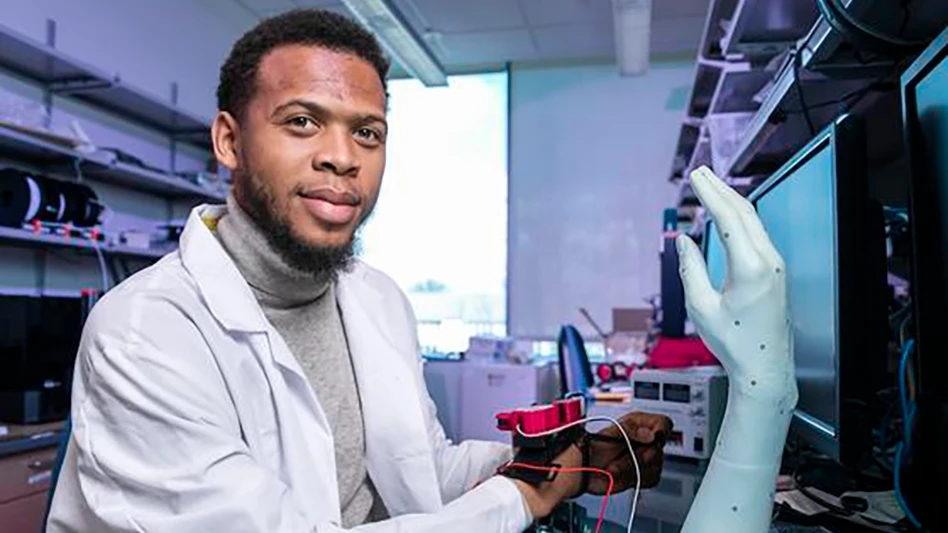

- Flexing prosthetic finger offers lifelike appearance and movement

- How the fast-evolving defense market impacts suppliers

- Medtronic’s Hugo robotic-assisted surgery system makes US debut