CREDIT: ADOBE STOCK 481472507 | BY J-MEL

Johnson & Johnson intends to separate its orthopedics business to enhance the strategic and operational focus of each company and drive value for stakeholders.

The intended separation would further strengthen the focus of Johnson & Johnson as an innovation powerhouse, serving areas of high unmet needs across innovative medicine and medtech, accelerating the ongoing shift of the company’s medtech portfolio toward higher-growth and higher-margin markets. The transaction would establish a standalone orthopedics business, operating as DePuy Synthes, that would be the largest, most comprehensive orthopedics-focused company with leading market share positions across major categories.

“This transaction enables Johnson & Johnson to further strengthen its focus and investment toward higher-growth areas where we can meaningfully extend and improve patient lives,” says Joaquin Duato, chairman and chief executive officer, Johnson & Johnson. “The planned separation reflects our long-standing commitment to portfolio optimization and value creation. We are confident that our orthopedics business will be better positioned to improve top-line growth and operating margins as a standalone business.”

Following the completion of the separation, Johnson & Johnson will retain a leadership position in six key growth areas across its innovative medicine and medtech segments – oncology, immunology, neuroscience, cardiovascular, surgery, and vision. The company expects that the separation will increase its top-line growth and operating margins. Johnson & Johnson remains committed to maintaining a strong balance sheet and its consistent capital allocation priorities of R&D investment, annually increasing competitive dividends, value-creating acquisitions and share repurchases.

“This move would further enhance the market-leading position for DePuy Synthes and strengthen our overall medtech business with a focus on cardiovascular, surgery and vision,” adds Tim Schmid, executive vice president, worldwide chairman, medtech. “Through the separation process, we will remain focused on setting our talented teams up for long-term success, while continuing to serve our customers and create healthier futures for patients around the world.”

DePuy Synthes

Upon completion of the planned separation, DePuy Synthes would be the largest, most comprehensive orthopedics-focused company, with leading market share positions across major product categories. Following the transaction, DePuy Synthes is expected to benefit from a more focused business model and be better positioned to advance patient care while delivering clinical and economic value to health care systems worldwide. DePuy Synthes would continue to address a $50 billion+ global market opportunity and serve approximately seven million patients annually through its wide range of products and services. For fiscal year 2024, the orthopedics business generated approximately $9.2 billion in sales. DePuy Synthes would be expected to have an investment-grade profile and balance sheet that would allow it to build on its long history of innovation and maintain and extend its leadership position.

DePuy Synthes worldwide president appointment

The Company also announced that Namal Nawana has been appointed to serve as worldwide president, DePuy Synthes, effective immediately. Nawana will lead the business through the separation process, reporting directly to Duato, and is expected to continue to lead DePuy Synthes following the completion of the separation.

Nawana most recently served as executive chairman and founder of Sapphiros, a privately held platform company dedicated to building the next generation of consumer diagnostic technologies. Previously he served as chief executive officer and a member of the Board of Directors of Smith & Nephew Plc, a global medical technology business. Prior to that, he served as president and chief executive officer and a member of the Board of Directors of Alere Inc., a leading point of care diagnostics company, until its acquisition by Abbott. Before joining Alere, he spent more than 15 years at Johnson & Johnson in progressively senior leadership roles globally, including his final role at the company, worldwide president of Johnson & Johnson’s DePuy Synthes Spine business.

Duato adds, “Namal brings extensive experience leading global public companies and a demonstrated track record of success in growing medical devices businesses. We are pleased to have an executive of Namal’s caliber step into this role and are confident he is the ideal leader to guide the new DePuy Synthes into the future.”

Nawana comments, “I am honored to take on this role to lead the new DePuy Synthes, a global market leader with a deep heritage of innovation and a strong commercial platform that is well positioned to succeed as a standalone company. I look forward to working together with the broader team to meet our mission and keep people around the globe moving.”

Transaction Details

Johnson & Johnson intends to explore multiple paths to affect the planned separation. The Company is targeting completion within 18 to 24 months, subject to the satisfaction of certain conditions including, among others, consultations with works councils and other employee representative bodies, as may be required, final approval of the Johnson & Johnson Board of Directors, and the receipt of other regulatory approvals. There can be no assurance regarding the ultimate timing or structure of the proposed separation or that the transaction will be completed.

As the Company pursues this separation, Johnson & Johnson will continue to operate its orthopedics business in alignment with its current strategy, including continued investments in growth, margin improvement and innovation.

Advisors

Citi and Goldman Sachs & Co. LLC are acting as financial advisors to Johnson & Johnson and Freshfields LLP is acting as legal counsel.

Third-quarter 2025 results and conference call

In a separate press release issued, Johnson & Johnson announced its third-quarter results.

Johnson & Johnson will host a conference call for investors to review third-quarter results and discuss the proposed separation today at 8:30 a.m., Eastern Time. A simultaneous webcast of the call for investors and other interested parties may be accessed by visiting the Johnson & Johnson website. A replay and podcast will be available approximately two hours after the live webcast in the Investor Relations section of the company's website at events-and-presentations.

Latest from Today's Medical Developments

- Syringe-less injector system for diagnostic imaging obtains fourth FDA clearance

- Hohenstein Medical debuts enhanced medical device testing capabilities

- Arterex unveils unified brand identity

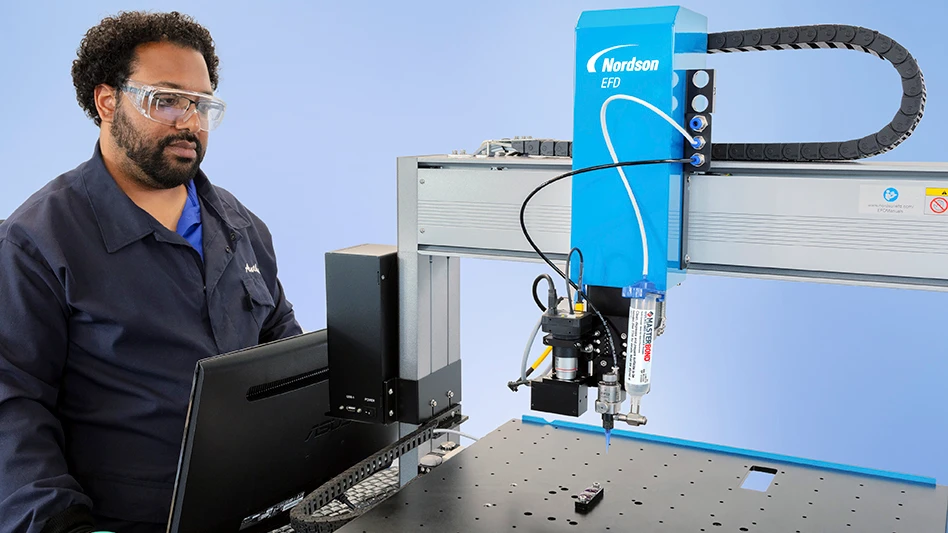

- Dymax demonstrates light-curing material solutions for medical devices

- Able Medical Devices showcases latest sternal closure solutions

- TMTS 2026 explores AI-powered sustainable manufacturing and more

- QT9 QMS platform streamlines quality management, compliance for medical device manufacturers

- Spineology releases patient-specific expandable spinal implant