AdobeStock_162212608_By_Atstock_Productions

The L.S. Starrett Company entered into a definitive merger agreement in a go-private transaction with an affiliate of MiddleGround Capital in an all-cash transaction for $16.19 per share. The purchase price represents an approximately 63% premium to the closing stock price of the Company’s stock on March 8, 2024, the last trading day prior to announcing the transaction.

“We are pleased to reach this agreement with MiddleGround, which provides a meaningful premium cash value to our shareholders,” says Douglas A. Starrett, chairman of the Board of Directors, CEO, and president. “Following comprehensive outreach to potential parties, our Board of Directors determined that MiddleGround is the right partner for Starrett because of its deep knowledge within the manufacturing industry. As a private company, the Company will have additional financial and operational flexibility to continue providing industry-leading service and products to our customers across our markets and maintaining Starrett’s proud tradition among its employees, communities and other stakeholders.”

“MiddleGround is thrilled to be partnering with Starrett, a brand we have long admired, and a company that we have followed in the public markets for several years. Most of MiddleGround's Operations team gained familiarity with Starrett products over the course of their manufacturing careers, and we are excited about the opportunity to further position the company for its future on the front lines of innovation, advanced manufacturing and reshoring,” says John Stewart, managing partner of MiddleGround.

Transaction details

The proposed transaction has been approved by the Starrett Board of Directors. MiddleGround intends to fund the transaction with a combination of cash from MiddleGround Partners III, L.P. and committed financing, which is not subject to any contingency.

The transaction is expected to close in mid-2024, subject to the requisite approval by Starrett’s shareholders and other conditions to closing.

Following completion of the transaction, Starrett will become a wholly owned subsidiary of MiddleGround and Starrett’s Class A common stock will no longer be listed on any public market.

Advisors

Lincoln International LLC is serving as lead financial advisor to Starrett and Ropes & Gray LLP is serving as legal counsel to Starrett.

William Blair & Company L.L.C. is serving as exclusive financial advisor to MiddleGround in connection with the acquisition and debt financing of Starrett and Dechert LLP is serving as legal counsel to MiddleGround.

Latest from Today's Medical Developments

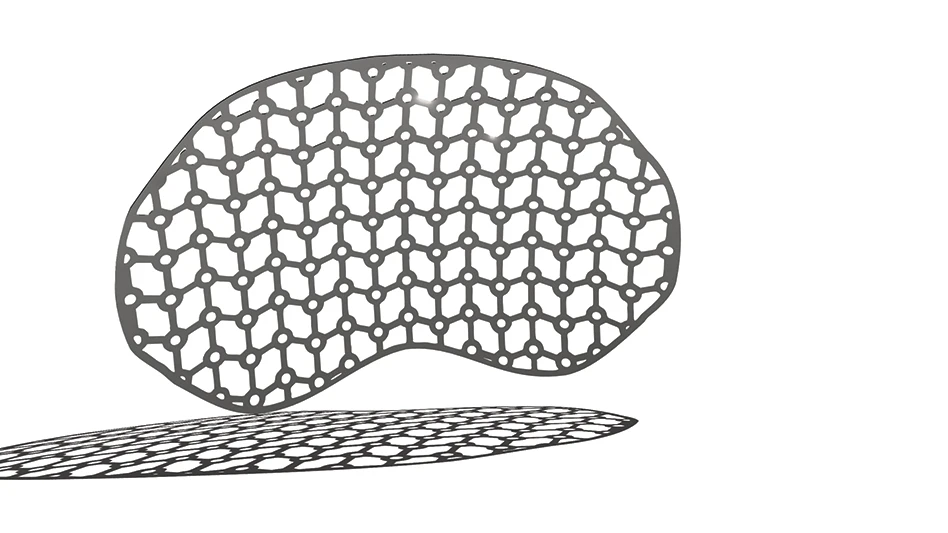

- Stryker’s flexible syndesmotic fixation device stabilizes ankle injuries

- Mergers & acquisitions news: MGS, Quantum Surgical bolster medtech portfolios

- Exchangeable-head solid carbide cutting tools

- NextDent 300 MultiJet printer delivers a “Coming of Age for Digital Dentistry” at Evolution Dental Solutions

- Get recognized for bringing manufacturing back to North America

- Adaptive Coolant Flow improves energy efficiency

- VOLTAS opens coworking space for medical device manufacturers

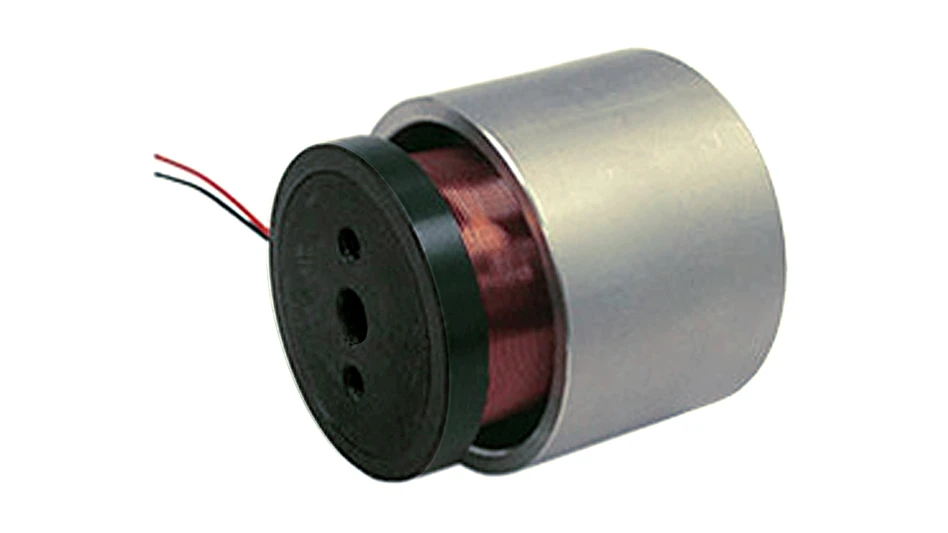

- MEMS accelerometer for medical implants, wearables