More than three quarters (79%) of investment managers surveyed in the latest Investment Manager Outlook (IMO), a quarterly survey conducted by Russell Investments, say that they do not believe the U.S. economy is entering a double-dip recession. The latest survey took place between August 23 and September 2, 2011.

When this subset of managers (the 79%) were asked what economic indicators support their position, 78% cited strong corporate balance sheets and high corporate profit levels and nearly half (49%) also pointed to the U.S. Federal Reserve's decision to keep interest rates low until mid-2013. Other economic indicators cited by managers as support for their opinions that the U.S. will avoid a double-dip recession include declining oil prices and U.S. dollar weakness. While they do not see a recession coming, 62% of this majority group indicated that they do expect growth to remain low for the next several years.

Among those managers who believe the U.S. economy is entering or already in a double-dip recession (11% and 10% respectively), recovery in employment levels was cited by 95% as the key requirement for either avoiding or leading the U.S. out of recession. This group also pointed to the need for improved consumer confidence/consumption (45%) and the resolution of U.S. and/or European debt issues (both 40%).

"We have seen a consistent spate of negative economic news that has certainly impacted investors' confidence in the markets and we continue to see notable volatility. Yet among professional money managers we are seeing a focus on fundamentals such as strong corporate profits that is supporting an overall bullish sentiment, particularly for large cap U.S. corporate stocks," says Rachel Carroll, client portfolio manager at Russell Investments. "While we believe managers' low expectations for overall economic growth are realistic, the collective bullish sentiment and their views on market valuations indicate that they see a buying opportunity in the equity markets."

Debate about the double-dip recession aside, more than half of the managers surveyed (57%) say the market is currently undervalued - more than double the percentage that felt the same in the June 2011 survey (26%). Only 10% of managers currently believe the market is overvalued, and 32% believe it is fairly valued (dropping from 61% in June).

Manager optimism regarding U.S. large cap equities saw an increase in the latest survey, likely reflecting their views on opportunities in the equity markets. Bullish sentiment for U.S. large cap growth stocks increased 13% points from the June survey to 73%, and bullishness for U.S. large cap value stocks hit an all-time survey high at 63%, up 14% points from June.

Bullishness for emerging market equities also saw a notable increase in the latest survey, reaching an all-time survey high at 74%, up 15% points from June. Over the same period, bullishness for non-U.S. (developed market) equities fell eight percentage points to 45%.

"At the time of the survey, many managers were clearly considering the market impact of the U.S. debt ceiling and downgrade issues and the ongoing European sovereign debt crisis, and likely see the emerging markets as a comparatively stable option based on steady growth rates and an expanding consumer base," Carroll says.

Carroll adds, "Though Russell believes we will avoid a double-dip recession, the uncertainty around resolution of the European debt issue has caused market volatility to spike, and we believe it is currently the dominant issue and greatest threat to systematic stability. Yet while investors often view market volatility as reason to flee the equity markets, professional money managers have a longer-term perspective and a pragmatic sense of where opportunities might lie -- which demonstrates how important it is for individual investors to work with a qualified financial professional who can help them make sense of market events like we saw recently."

Russell's Investment Manager Outlook is an ongoing survey intended to generate a meaningful snapshot of investment manager sentiment each quarter. For the current installment of the survey, Russell collected the opinions of U.S. senior-level investment decision makers at equity investment management firms as well as at fixed-income investment management firms. Additional findings from the latest Investment Manager Outlook include:

Most Major Sectors see Increase in Bullish Sentiment

Every sector except health care (down 5% points since June) saw an increase in bullishness in the latest survey. At 71% bullishness, the technology sector continues its long-standing run as the most-favored sector amongst managers surveyed, up 6% points from June.

Manager bullishness for the producer durables and consumer discretionary sectors also saw notable increases of nine and six percentage points respectively, while bullishness for the energy sector increased slightly to 57% against the backdrop of volatility in the markets and oil prices.

According to Carroll, "Producer durables is a late-cyclical indicator, as spending on heavy machinery and other sub-industries of this sector is often seen later in the economic cycle. It is also driven primarily by corporate spending and not by consumers, which underscores managers' beliefs that corporations have capital to spend, while consumers haven't recovered yet. The uptick for the producer durables sector is also consistent with the continued bullishness for emerging markets equities, where a significant amount of this type of machinery spending is likely to occur."

About Investment Manager Outlook

Prior to the end of each quarter, Russell polls a sample of investment managers to collect top-line opinions about their outlook for the direction of the markets, sectors and asset classes to watch, and trends on the horizon that could impact investment strategy. In addition to the quantitative results, the Investment Manager Outlook provides qualitative analysis and commentary from one of Russell's senior investment strategists. Detailed results and analysis from the Investment Manager Outlook are available on http://www.Russell.com/Helping-Advisors/Markets/InvestmentManagerOutlook.asp .

Latest from Today's Medical Developments

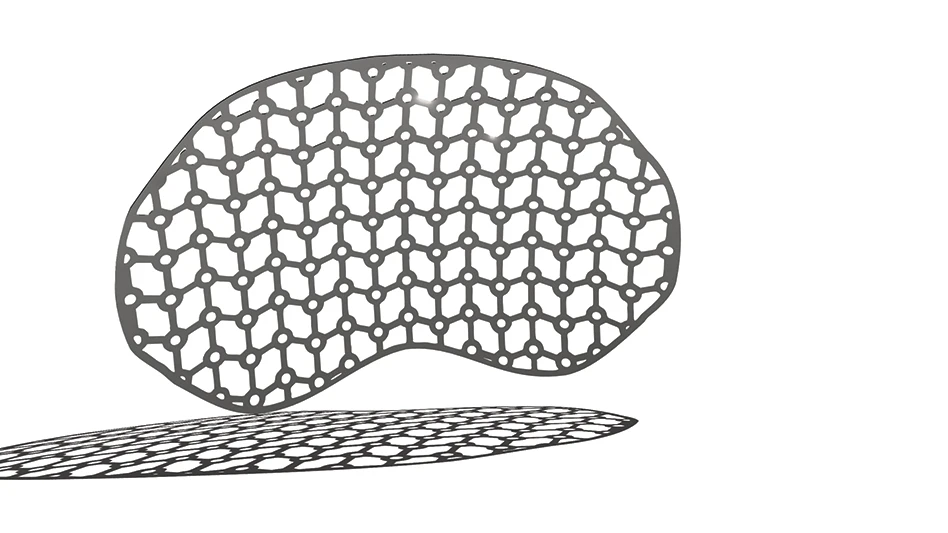

- Stryker’s flexible syndesmotic fixation device stabilizes ankle injuries

- Mergers & acquisitions news: MGS, Quantum Surgical bolster medtech portfolios

- Exchangeable-head solid carbide cutting tools

- NextDent 300 MultiJet printer delivers a “Coming of Age for Digital Dentistry” at Evolution Dental Solutions

- Get recognized for bringing manufacturing back to North America

- Adaptive Coolant Flow improves energy efficiency

- VOLTAS opens coworking space for medical device manufacturers

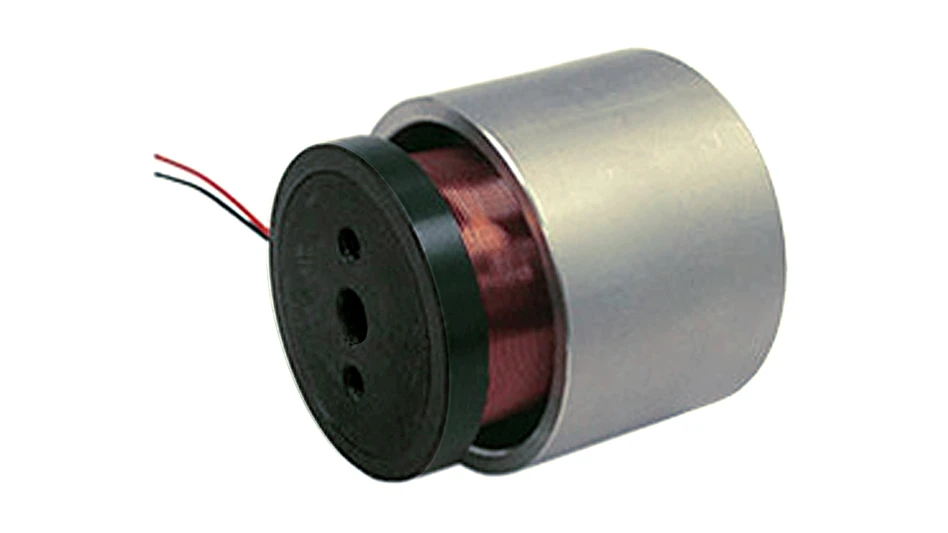

- MEMS accelerometer for medical implants, wearables