Vancouver, British Columbia – According to a report by iData Research, the leading global authority in medical device market research, the market for enteral feeding devices is expected to reach over $750 million in the U.S. and Europe combined. The market is comprised of initial PEG placement kits, PEG replacement tubes, DPEJ tubes, PEG/J tubes. The enteral feeding replacement device market is segmented into low-profile balloon tubes, low-profile non-balloon tubes, nasogastric and nasojejunal tubes, enteral feeding pumps and G-tubes.

More than 17 million enteral feeding device placement procedures are expected to occur in the U.S. and Europe by 2020. Most enteral feeding procedures are performed on infants, children, and elderly patients who suffer from physical or mental disorders, as well as larynx and esophageal cancer patients who require feeding for short periods of time.

“The number of pediatric enteral feeding procedures being performed has been steadily increasing over the past several years,” says Dr. Kamran Zamanian, CEO of iData. “This may be attributed to the reimbursement rate for pediatric enteral feeding procedures is approximately three times greater than for adult procedures.”

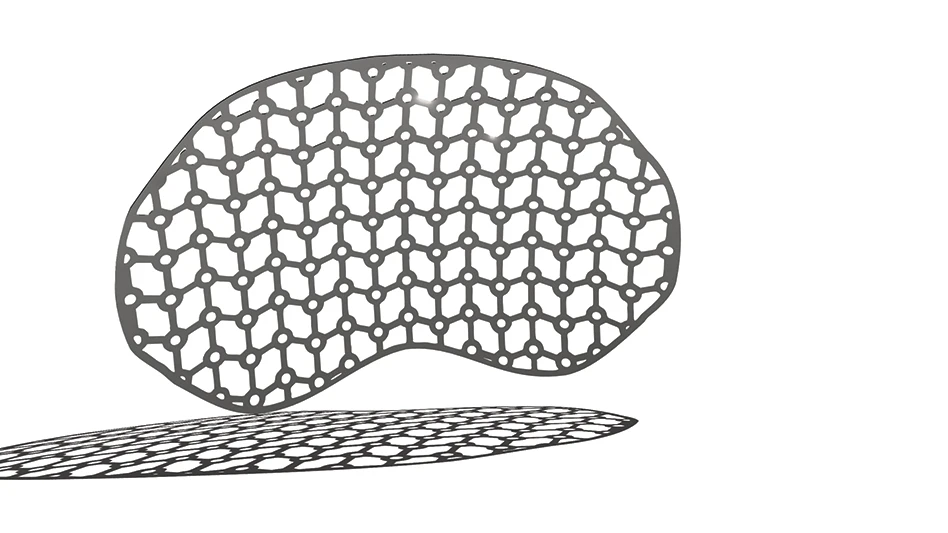

Markets for replacement devices such as low-profile balloon buttons and non-balloon buttons are growing the fastest in the enteral feeding market. Health authorities and hospitals are emphasizing the need to reduce length of hospital stay. This is driving tube feed, low-profile buttons and replacement device demand and consumption in alternate care and homecare settings. Replacement procedures can also be easily performed at home or in nursing facilities, whereas initial placement procedures are performed in hospitals or clinics.

The global series on the “Markets for Gastrointestinal Endoscopic Devices” covers 21 countries including the U.S., Canada, Japan, India, China, and 15 countries in Europe. The full reports provide a comprehensive analysis including procedure numbers, units sold, market value, forecasts, as well as a detailed competitive market shares and analysis of major players’ success strategies in each market and segment.

Markets covered include GI endoscopes, capsule endoscopy, virtual colonoscopy, stenting and dilation devices, ERCP devices, biopsy forceps, polypectomy snares, FNA devices, specimen and foreign body removal devices, hemostasis devices, anti-reflux devices, and enteral feeding devices.

Receive a free synopsis of this report.

Source: iDataResearch

Latest from Today's Medical Developments

- Stryker’s flexible syndesmotic fixation device stabilizes ankle injuries

- Mergers & acquisitions news: MGS, Quantum Surgical bolster medtech portfolios

- Exchangeable-head solid carbide cutting tools

- NextDent 300 MultiJet printer delivers a “Coming of Age for Digital Dentistry” at Evolution Dental Solutions

- Get recognized for bringing manufacturing back to North America

- Adaptive Coolant Flow improves energy efficiency

- VOLTAS opens coworking space for medical device manufacturers

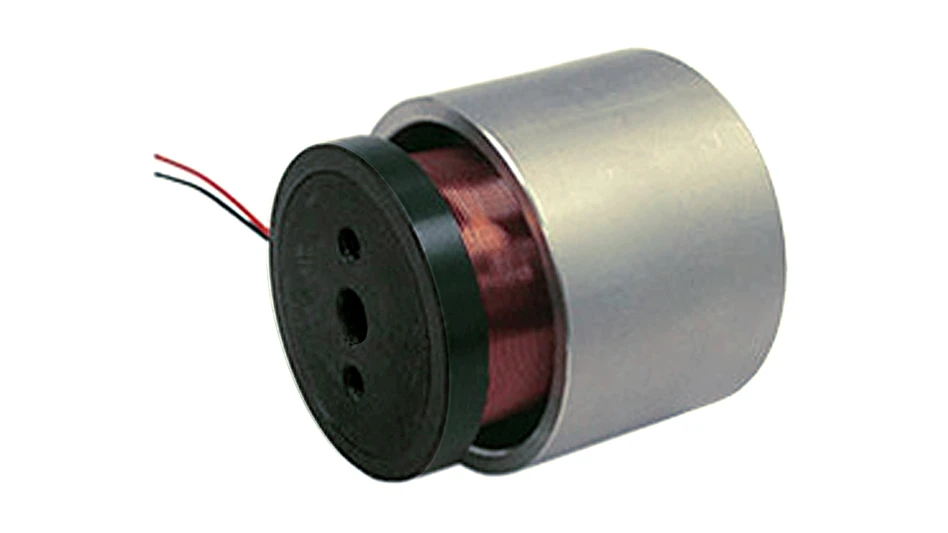

- MEMS accelerometer for medical implants, wearables