Vancouver, British Columbia – According to a new report published by iData Research, the U.S. large joint restoration market, which includes hip and knee restorations as well as bone cement sales, is projected to pass the USD $9 billion mark this year. Knee restorations lead the way, making up more than half of the market's value.

"Solid market growth here is largely driven by demographics," explains Dr. Kamran Zamanian, CEO of iData. "The majority of knee arthroplasty patients are aged 60 and above, and usually require a total knee replacement. By this stage, it is more likely that the entire knee is suffering from arthritis." As U.S. citizens live longer, healthier lives, the pool of potential knee and hip restoration patients continues to grow.

Other key findings from the iData Research report, "U.S. Market for Large Bone and Joint Orthopedic Devices":

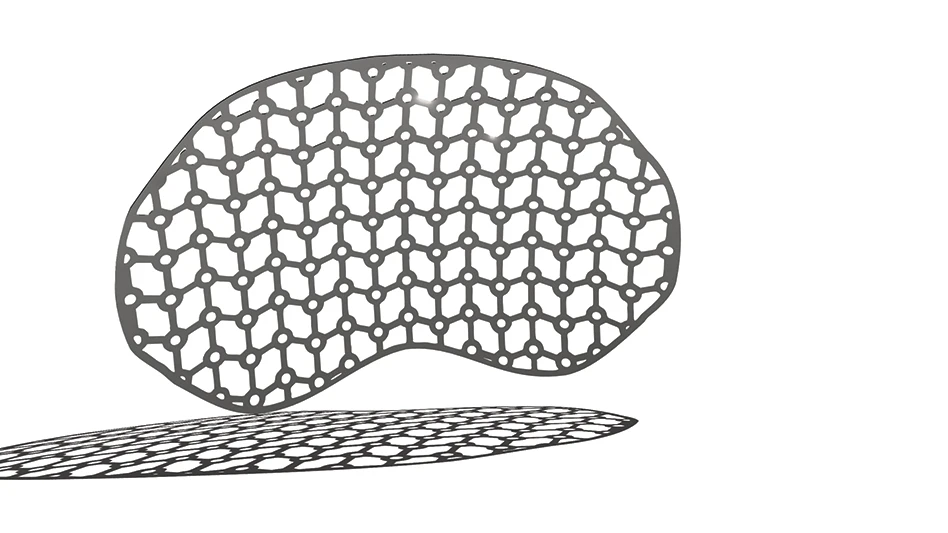

- Custom implant popularity

Custom patient implants have become an important talking point in the knee arthroplasty market. Many companies offer instruments such as cutting blocks that are used to create the perfect implant for each individual patient. The use of cutting blocks allows surgeons to preserve more bone and increase the fit, thereby increasing functionality and decreasing healing time. - Revision procedures on the rise

Both the knee and hip revision markets have been experiencing strong growth due to an increase in procedures. This increase results from the number of younger joint replacement patients in the last two decades who will now be receiving revision surgeries as their implants begin to fail. On average, approximately 10% of all primary hip and knee replacements will require a revision. - Fierce competition for leading competitors

Three major companies vie for the top spot in the U.S. large joint restoration market: DePuy Synthes, Stryker, and Zimmer. Together, these companies make up more than half of the market's value. The next runners up are Smith & Nephew and Biomet; however, these two companies have less share than the top three.

Source: iData Research

Latest from Today's Medical Developments

- Stryker’s flexible syndesmotic fixation device stabilizes ankle injuries

- Mergers & acquisitions news: MGS, Quantum Surgical bolster medtech portfolios

- Exchangeable-head solid carbide cutting tools

- NextDent 300 MultiJet printer delivers a “Coming of Age for Digital Dentistry” at Evolution Dental Solutions

- Get recognized for bringing manufacturing back to North America

- Adaptive Coolant Flow improves energy efficiency

- VOLTAS opens coworking space for medical device manufacturers

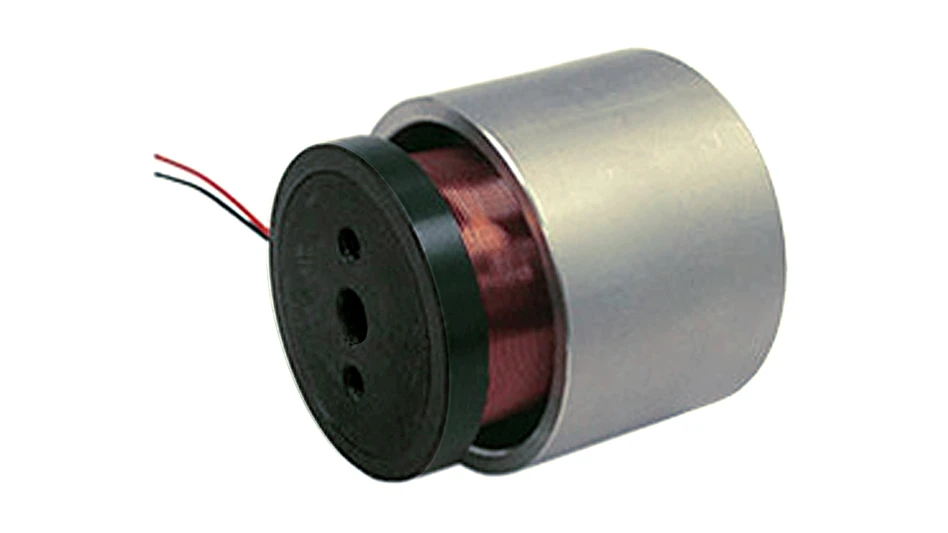

- MEMS accelerometer for medical implants, wearables