According to Millennium Research Group (MRG), the global authority on medical technology market intelligence, the medical excise tax that came into effect on January 1, 2013, will have a positive effect on the dental implant market size in the United States. Some manufacturers have indicated that they will increase their product prices to compensate for the new tax. Although this may result in some loss of share for these companies, industry sources indicate that this will overall have little effect on demand for these products because many customers will be willing to absorb the extra cost of the procedure for quality products, thus boosting the total market size in 2013.

In addition, prices will also be supported through 2021 by dentists returning to the use of premium-priced products in light of more stable economic conditions, as well as the rising adoption of custom-milled final abutments. Procedure volume expansion will also continue at a strong pace over the forecast period as a result of the aging population and increased patient awareness of dental implants. The combination of slight price increases and procedure volume expansion will result in the US dental implant market growing at a compound annual growth rate of about 9% between 2011 and 2021.

This market is characterized by a few niche segments, namely small-diameter and short-length implants, which remain small segments because of the limited indications for their use. These markets will, however, experience faster growth due to an increasing awareness of the benefits of these products in certain situations.

"The small-diameter implant segment will remain less than 5% of the total dental implant fixture market over the 10-year forecast," states MRG Senior Analyst April Lee. "With that said, however, it is expected to experience slightly faster growth than the regular-diameter implant market. This is due to the advantages of these products, such as their less invasive nature and easier placement, and an increasing interest in 2-piece small-diameter implants."

Regular-diameter, short-length implants are also gaining in popularity because of increased marketing campaigns that have created more awareness of these devices. Additionally, greater recognition of their utility in patients with insufficient bone mass and in cases where there is risk of hitting the trigeminal nerve will promote the uptake of short-length implants.

Millennium Research Group's U.S. Markets for Dental Implants 2013 report includes unit, procedure, average selling price and revenue information, along with market drivers and limiters and a competitive landscape for dental implant fixtures and final abutments in the United States.

Latest from Today's Medical Developments

- Stryker’s flexible syndesmotic fixation device stabilizes ankle injuries

- Mergers & acquisitions news: MGS, Quantum Surgical bolster medtech portfolios

- Exchangeable-head solid carbide cutting tools

- NextDent 300 MultiJet printer delivers a “Coming of Age for Digital Dentistry” at Evolution Dental Solutions

- Get recognized for bringing manufacturing back to North America

- Adaptive Coolant Flow improves energy efficiency

- VOLTAS opens coworking space for medical device manufacturers

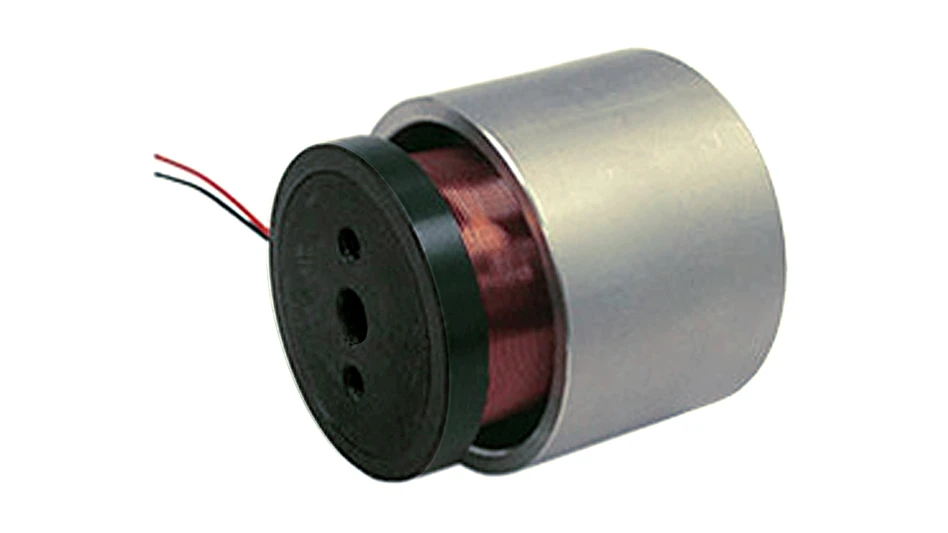

- MEMS accelerometer for medical implants, wearables