SenoRx Inc. has entered into a definitive merger agreement with C. R. Bard at a price of $11 per share, or approximately $213 million in the aggregate. The SenoRx board of directors unanimously approved the agreement and will recommend that the Company's shareholders approve the transaction.

Under the terms of the merger agreement, SenoRx stockholders will receive $11 in cash for each share that they hold at the closing of the merger, representing a 14 percent premium over the closing price on May 4, 2010 and a 41 percent premium over the company's average closing price during the 90 trading days ended May 4, 2010. The acquisition is subject to certain closing conditions specified in the definitive agreement, including regulatory approvals and the approval of SenoRx's stockholders. The transaction is expected to close in the third quarter of 2010.

"Our agreement with Bard represents an attractive valuation for SenoRx shareholders, and as an all cash offer, provides liquidity for shareholders," says John Buhler, SenoRx President and Chief Executive Officer. "We believe the merger represents a great opportunity for the combined companies to create product leadership by offering a broader range of high-quality breast care products to our customers."

Latest from Today's Medical Developments

- Gore completes acquisition of Conformal Medical

- Medical textiles designed for cardiovascular, orthopedic, dental prosthetic applications

- Micro-precision 3D printing: Trends and breakthroughs in medical device manufacturing

- One-component, dual-cure adhesive system for medical device assembly

- #82 Manufacturing Matters - Forecasting 2026 with GIE Media's Manufacturing Group

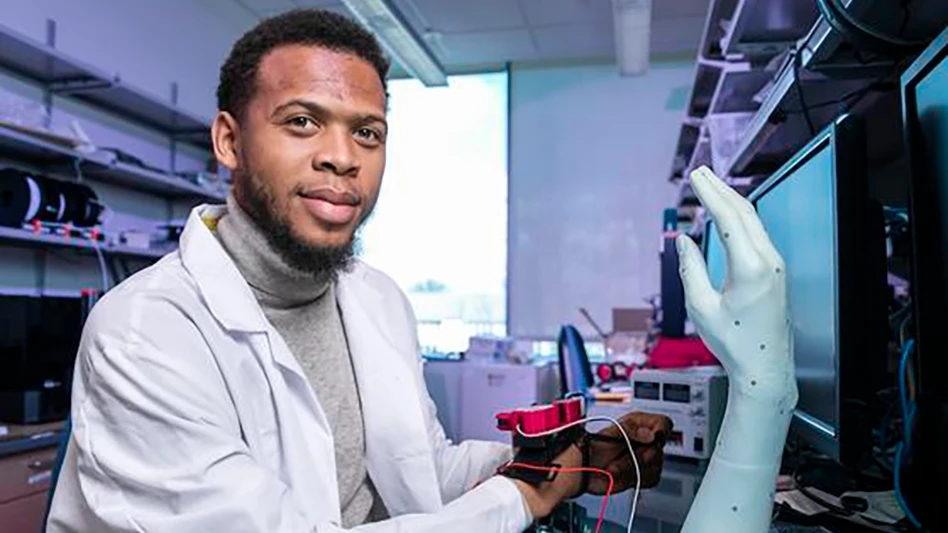

- Flexing prosthetic finger offers lifelike appearance and movement

- How the fast-evolving defense market impacts suppliers

- Medtronic’s Hugo robotic-assisted surgery system makes US debut