A survey by MassMEDIC and Tatum, with plans to continue of a quarterly basis, show that medical device manufacturers in the Bay State indicates cautious optimism about the economy, with a majority expecting improved business conditions this year.

The full release can be read here.

A survey of 47 medical device manufacturers, ranging from pre-revenue firms to those with sales topping $100 million, indicates a sense of cautious optimism when it comes to the economy.

The survey, conducted by executive services provider Tatum LLC for the Massachusetts Medical Device Industry Council (MassMEDIC), polled device makers during the fourth quarter on a variety of business indicators. Most — more than 58 percent — said they expected conditions to improve during the last 60 days of the quarter. Nearly 35% reported improvement during the 30 days preceding the survey.

MassMEDIC president Tom Sommer said the survey, the group's second quarterly poll, delivered similar results for the fourth quarter as the third.

Other results of the survey included:

- Sales backlog:

- 33.3% of respondents saw an increase in the last 30 days. More than 23% reported declines and 43.6% reported flat sales backlogs.

- Only 10.3% of respondents predicted a potential decline in the sales backlog during the last 60 days of the quarter; 48.7% expected improvement and 41% expected their sales backlog to remain the same.

- Financing Conditions:

- Nearly 15% of respondents saw improved financing conditions during the first month of the fourth quarter, 70.7% saw no change and 14.6% confronted worsening financing conditions.

- In the final 60 days of the quarter, 34.1% expected financing conditions to improve, 56.1% believed they would stay the same and 9.8% thought they would worsen.

- According to respondents, the major challenges to recovery over the next six months were evenly split between the inability to accurately forecast revenue, a lack of capital investing and sluggish consumer spending.

- Only 4.9 percent expected a stronger rate of spending within the 30 days after the survey; 12.2 percent expected their rate of spending to increase within the next 90 days. Nearly 20 percent expected spending to pick up three to six months from now, and 36.6 percent believed an uptick will take place this year. Nearly 27 percent abstained from providing time frame for resuming spending.

- More than 58 percent of respondents said their first step would be to begin hiring. Nearly 21 percent said they planned to release capital expenditure spending, 10.3 percent expected to build inventory and 13.8 percent to increase pricing.

- Nearly two-thirds of respondents experienced overall growth last year, with a fourth reported flat growth and 3 percent reporting declines. Nearly 7 percent said they were still tallying up the numbers for 2009 at the time of the survey.

Source: Tatum LLC for the Massachusetts Medical Device Industry Council (MassMEDIC)

Latest from Today's Medical Developments

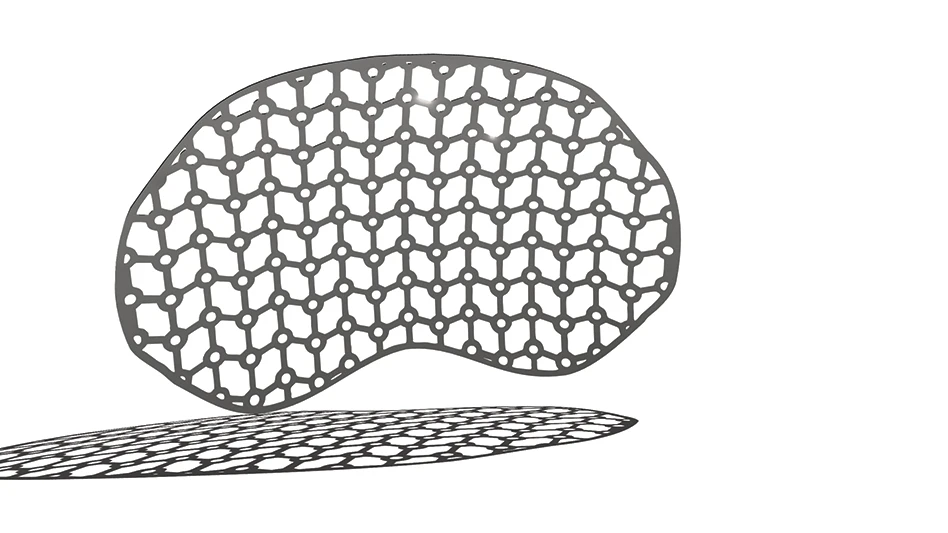

- Stryker’s flexible syndesmotic fixation device stabilizes ankle injuries

- Mergers & acquisitions news: MGS, Quantum Surgical bolster medtech portfolios

- Exchangeable-head solid carbide cutting tools

- NextDent 300 MultiJet printer delivers a “Coming of Age for Digital Dentistry” at Evolution Dental Solutions

- Get recognized for bringing manufacturing back to North America

- Adaptive Coolant Flow improves energy efficiency

- VOLTAS opens coworking space for medical device manufacturers

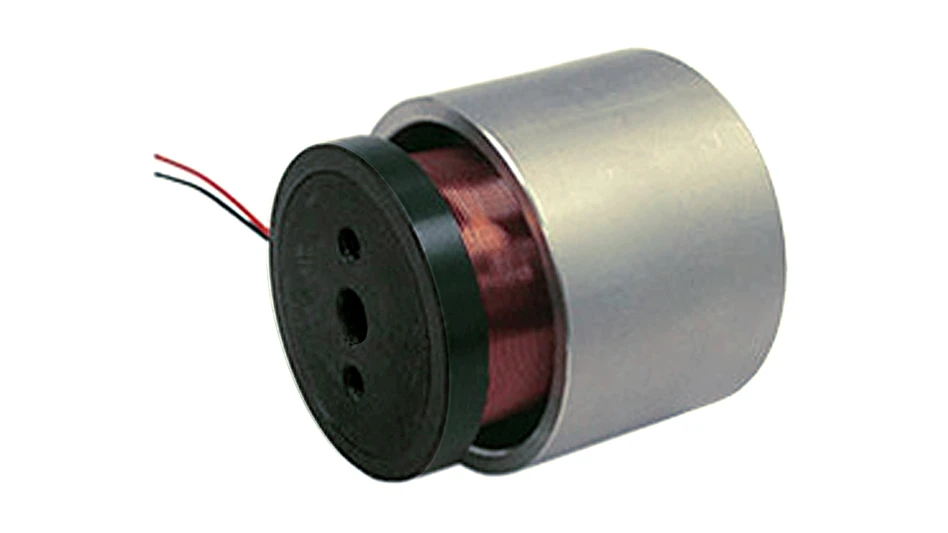

- MEMS accelerometer for medical implants, wearables