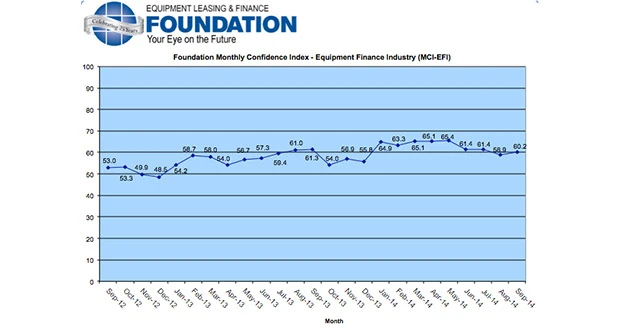

Washington, DC – The Equipment Leasing & Finance Foundation officials have released the September 2014 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI). Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $827 billion equipment finance sector. Overall, confidence in the equipment finance market is 60.2, an increase from the August index of 58.9.

When asked about the outlook for the future, MCI-EFI survey respondent Valerie Hayes Jester, president, Brandywine Capital Associates Inc., said, “We are experiencing stronger demand than in the past several months, which bodes well for a strong fourth quarter. There is still concern for yield erosion, but we look forward to concluding the year on a positive trend.”

September 2014 Survey Results:

The overall MCI-EFI is 60.2, an increase from the August index of 58.9.

- When asked to assess their business conditions over the next four months, 36.4% of executives responding said they believe business conditions will improve over the next four months, up from 18.2% in August. 60.6% of respondents believe business conditions will remain the same over the next four months, down from 78.8% in August. 3% believe business conditions will worsen, unchanged from the previous month.

- 30.3% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, up from 21.2% in August. 66.7% believe demand will “remain the same” during the same four-month time period, down from 75.8% the previous month. 3% believe demand will decline, unchanged from August.

- 15.2% of executives expect more access to capital to fund equipment acquisitions over the next four months, unchanged from August. 84.8% of survey respondents indicate they expect the “same” access to capital to fund business, and none expects “less” access to capital, both also unchanged from the previous month.

- When asked, 30.3% of the executives reported they expect to hire more employees over the next four months, a decrease from 33.3% in August. 60.6% expect no change in headcount over the next four months, up from 57.6% last month. 9.1% expect fewer employees, unchanged from August.

- 6.1% of the leadership evaluates the current U.S. economy as “excellent,” unchanged from last month. 87.9% of the leadership evaluates the current U.S. economy as “fair,” and 6.1% rate it as “poor,” both also unchanged from August.

- 27.3% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 30.3% who believed so in August. 66.7% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, unchanged from August. 6.1% believe economic conditions in the U.S. will worsen over the next six months, up from 3% who believed so last month.

- In September, 15.2% of respondents indicate they believe their company will increase spending on business development activities during the next six months, a decrease from 21.2% in August. 84.8% believe there will be “no change” in business development spending, an increase from 78.8% last month. None believe there will be a decrease in spending, unchanged from last month.

How to access the MCI-EFI?

Survey results are posted on the Foundation website, http://www.leasefoundation.org/research/mci/, included in the Foundation Forecast newsletter and included in press releases. Survey respondent demographics and additional information about the MCI are also available at the link above.

Source: The Equipment Leasing & Finance Foundation

Latest from Today's Medical Developments

- Exchangeable-head solid carbide cutting tools

- NextDent 300 MultiJet printer delivers a “Coming of Age for Digital Dentistry” at Evolution Dental Solutions

- Get recognized for bringing manufacturing back to North America

- Adaptive Coolant Flow improves energy efficiency

- VOLTAS opens coworking space for medical device manufacturers

- MEMS accelerometer for medical implants, wearables

- The compact, complex capabilities of photochemical etching

- Moticont introduces compact, linear voice coil motor