The ever-widening industrial digital ecosystem has manufacturers juggling rising investments in technologies with expectations these investments will lower costs and generate new revenue. At the same time, adoption of these technologies are forcing manufacturers on paths to fundamentally transform their business models - and cultures - as a result. As adoption rates of digital manufacturing technologies cross the threshold to mainstream, PwC’s latest survey uncovers how businesses are wading into an era of true re-invention.

Key U.S. findings from the Manufacturing’s next big act: Building an industrial digital ecosystem report include:

- Manufacturers are raising investment in digital technologies: In the last two years, U.S. manufacturers invested an average of 2.6% of their annual revenue in digital technologies, and according to the PwC/Strategy& survey, the investment is expected to increase to almost 5% of revenue in the next five years, an estimated $350 billion.

- Venture capital firms are also investing in the digital operations technology space, with $3.6 billion was poured into start-ups since 2011, according the PwC/NVCA MoneyTree Report, with data from Thomson Reuters. This reflects an increase of nearly 50% annually, with start-up investments focused on manufacturing software, ERP and inventory software, and robotics and sensor technology.

- Companies are also considering acquisition of organizations with digital capabilities. PwC/Strategy& analysis shows that more than $6 billion has been invested in “digital deals” in North America since 2012, comprising 15% of all M&A deals over that period.

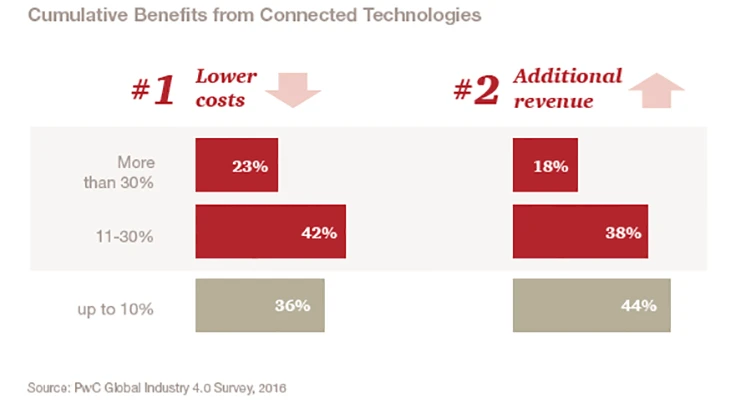

- Manufacturers expect digital investments to lower costs and generate new revenue: Nearly two-thirds of those surveyed expect that adopting digital manufacturing technologies will lower operating costs by at least 11%, mostly through efficiencies gained by automating processes and production.

- Over half of these manufacturers also expect to boost revenues by at least 11% by their digital ecosystem development enabling “smart” production, and new products and business models such as “pay-as-you-go.”

- However, not all digital technologies will yield cost-cutting and revenue generation for all manufacturers to the same degree. Companies should take a tailored approach to calculating a “digital ROI,” depending on the nature and breadth of the company’s digital strategy.

- The greatest challenges to building a digital vision are cultural: Three of the top 10 challenges identified through the PwC/Strategy& survey relate to organizational readiness and financial concerns. Some companies anticipate high investment requirements with unclear return on investment and lack of digital standards and issues related to data security and intellectual property are also noted.

- Companies who are going through or are looking to start their digital manufacturing transformation need to assess their assets continually to determine whether there is potential impact of changes to those assets by adding layers of digitalization and connectivity. And then ultimately figuring out how to monetize those changes. This initial strategy assessment informs the strategic choices that form a blueprint for an execution of a “digital evolution.”

Source: PwC

Latest from Today's Medical Developments

- NextDent 300 MultiJet printer delivers a “Coming of Age for Digital Dentistry” at Evolution Dental Solutions

- Get recognized for bringing manufacturing back to North America

- Adaptive Coolant Flow improves energy efficiency

- VOLTAS opens coworking space for medical device manufacturers

- MEMS accelerometer for medical implants, wearables

- The compact, complex capabilities of photochemical etching

- Moticont introduces compact, linear voice coil motor

- Manufacturing technology orders reach record high in December 2025