St. Jude Medical Inc. is pulling out of the Advanced Medical Technology Association, citing a disagreement over congressional proposals to tax medical devices to help pay for health care reform.

Daniel Starks, the chairman and CEO of St. Jude, says it was “inappropriate for AdvaMed to advocate for a specific policy that economically advantages a portion of its membership at the expense of other members,” according to a November 2, 2009 letter to AdvaMed obtained by Dow Jones Newswires.

AdvaMed has proposed that medical devices that are more complex should be taxed more - a situation that would disadvantage med-tech firms, including Little Canada, MN-based St. Jude, that specialize in high-tech products such as defibrillators.

Another maker of complex medical devices, Fridley, MN-based Medtronic Inc., also opposed AdvaMed’s tiered taxing scheme proposal. However, a spokesman for the company told Dow Jones that it does not plan to change its status with the trade group.

Health reform legislation passed by the Senate Finance Committee would raise $40 billion from medical device taxes over the next 10 years, though the final bill to be voted on in the Senate could pare down that amount. The bill passed by the U.S. House would raise $20 billion, with the taxes not starting until 2013.

Latest from Today's Medical Developments

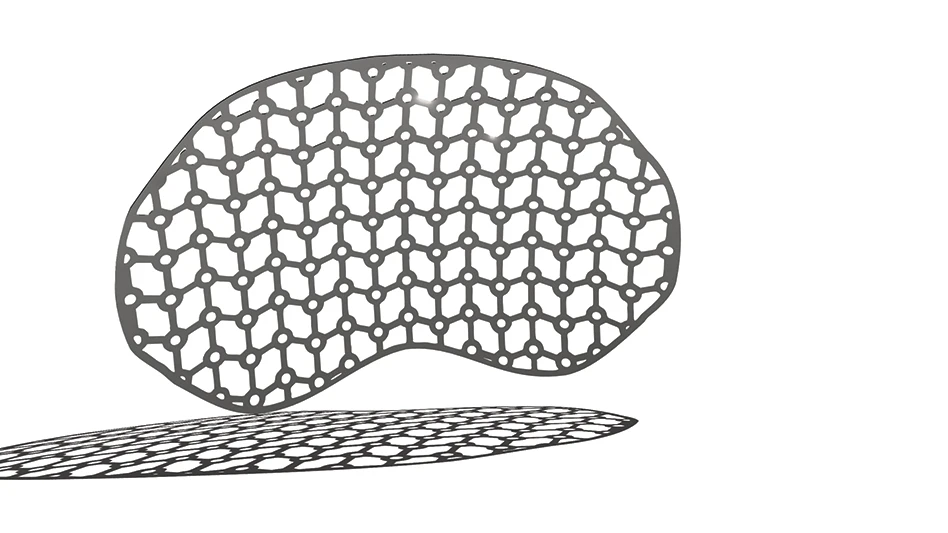

- Stryker’s flexible syndesmotic fixation device stabilizes ankle injuries

- Mergers & acquisitions news: MGS, Quantum Surgical bolster medtech portfolios

- Exchangeable-head solid carbide cutting tools

- NextDent 300 MultiJet printer delivers a “Coming of Age for Digital Dentistry” at Evolution Dental Solutions

- Get recognized for bringing manufacturing back to North America

- Adaptive Coolant Flow improves energy efficiency

- VOLTAS opens coworking space for medical device manufacturers

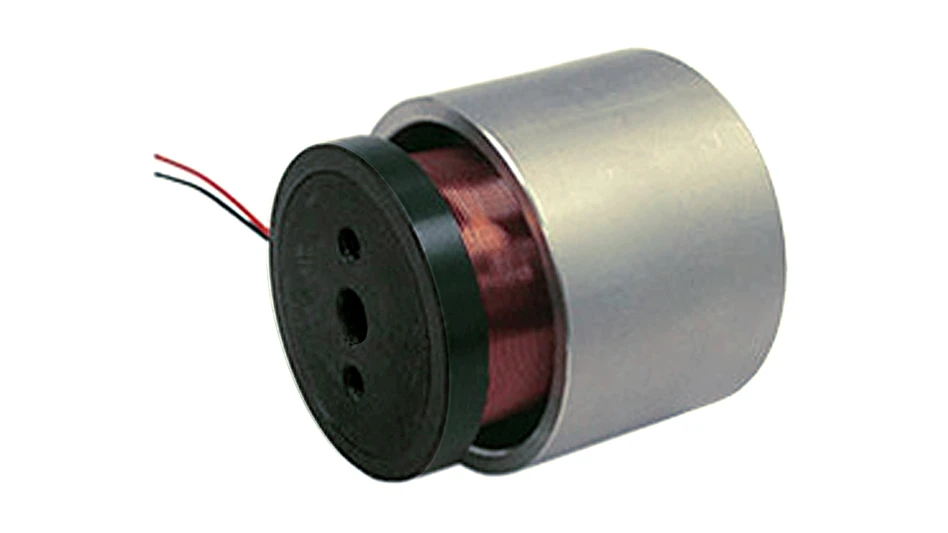

- MEMS accelerometer for medical implants, wearables