More than 400 companies and business organizations from across the United States this week urged Congress to approve legislation to strengthen and make permanent the R&D tax credit before it expires on December 31, 2009.

Today, more than 70% of the benefits of the credit are attributable to the salaries of workers performing U.S. based research. President Barack Obama in recent months has called for the Credit to be made permanent.

In a letter sent to Congressional leadership and every member of the U.S. Congress, the companies wrote:

"The R&D tax credit encourages businesses of all sizes to undertake cutting-edge research projects in the United States. R&D is the very lifeblood of our knowledge economy. At a time when the American economy is weak, research and development across industry sectors makes it possible to create and maintain good, high-paying jobs at home and sharpens the ability of companies to compete in the global marketplace.

"Failure to enact a permanent and strengthened credit will have significant negative consequences for the U.S. economy and threatens investments we need to make in important areas of the economy such as renewable energy and energy efficiency technologies, health care, biotechnology, manufacturing processes, and information and communications technologies. Now is not the time to back away from the spirit of invention. Now is the time to embrace it wholeheartedly. Businesses need certainty to make long-term, high risk investments in the U.S. Furthermore, a strengthened credit will be more competitive with incentives provided by other countries that are vying for research investment dollars.

"We respectfully urge you to approve legislation to strengthen and make permanent the R&D tax credit as soon as possible."

Earlier this year, President Obama said that the R&D Credit "returns $2 to the economy for every dollar we spend. Yet over the years we've allowed this credit to lapse or we've extended it year to year - even just a few months at a time. Under my budget, this tax credit will no longer fall prey to the whims of politics and partisanship."

Companies and organizations signing the letter to Congress represent virtually every industry sector from manufacturing, health care, energy, technology, pharmaceuticals, telecommunications, aerospace, agriculture, biotechnology and more. A copy of the letter is available upon request and is available on the R&D Credit Coalition website at www.investinamericasfuture.org.

Facts About the R&D Credit:

- The R&D Credit, created by Congress in 1981, spurs the creation of U.S.-based innovation and economic activity. It has fostered private sector R&D investment by companies of all sizes, helping to bring new, improved products and services to market. The list of these is nearly endless: energy-efficient appliances, new vaccines, faster Internet and communications capabilities, safer transportation, and improved national security to name just a few.

- The R&D Credit is available only for certain qualified research performed in the U.S. and represents a "jobs" provision sinceapproximately 70% or more of the benefits of the credit are attributable to salaries of workers performing U.S. based research.

- Only R&D performed in the U.S. may qualify for the R&D Credit. The Credit stimulates innovation-producing R&D investments in all 50 states across nearly 18,000 small, medium and large companies, according to a report by Ernst & Young LLP.

- Innovation is an expensive, intricate and time-intensive enterprise that sparks a chain of investments in capital equipment, workers and spillover activities in every economic sector. In effect, the R&D Credit stimulates short-term business investment with long-term benefits to our economy.

- When the R&D Credit was first created, the U.S. had the distinction of providing the most generous tax treatment for research among all OECD nations. Today, that is not the case because the credit has been whittled away over the years due to our global competitors such as Canada, China, Japan and others that offer more aggressive R&D incentives. In fact, the U.S. has fallen out of the top 10 globally when measuring government incentives for private sector R&D and now measures 17th.

- A permanent extension of the Credit would enhance its incentive value because companies could count on the Credit throughout the term of their multiyear R&D projects. Uncertainty regarding the availability of the Credit automatically results in companies discounting its value.

Latest from Today's Medical Developments

- Gore completes acquisition of Conformal Medical

- Medical textiles designed for cardiovascular, orthopedic, dental prosthetic applications

- Micro-precision 3D printing: Trends and breakthroughs in medical device manufacturing

- One-component, dual-cure adhesive system for medical device assembly

- #82 Manufacturing Matters - Forecasting 2026 with GIE Media's Manufacturing Group

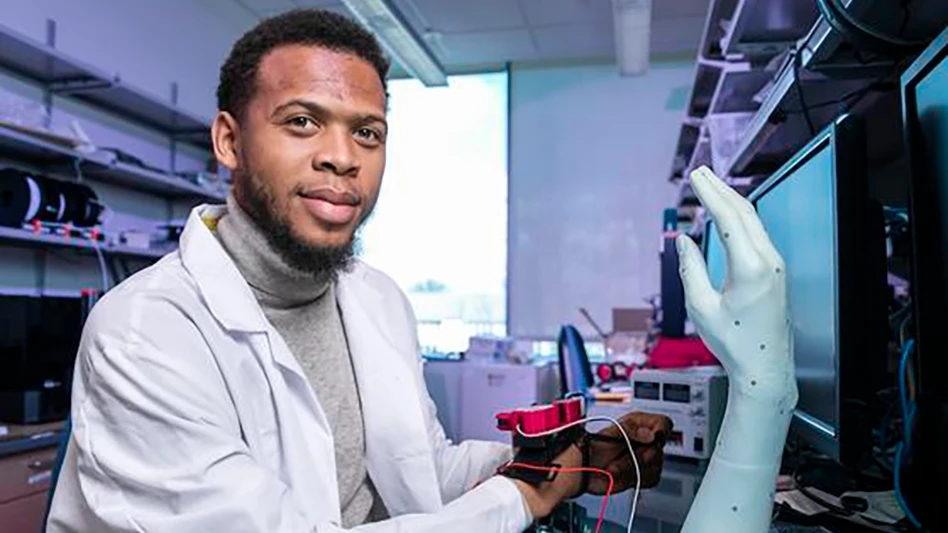

- Flexing prosthetic finger offers lifelike appearance and movement

- How the fast-evolving defense market impacts suppliers

- Medtronic’s Hugo robotic-assisted surgery system makes US debut