As practitioners of mergers and acquisitions in the healthcare industry, it’s important for us to keep track of the major trends within our business segment.

One would have to be on a remote island without the Internet for the past few months to not be aware of the recent rapid changes in machine learning (ML) and artificial intelligence (AI).

As we contemplate the impact of these changes, we realize the ability to implement practices to address these dynamics may be slower than the reality of the transformation taking place.

When we think about our M&A advisory service and our clients, we realize the future is unknown. However, what’s clear is there’ll be more opportunity for growth and success within our industry.

Let’s start with our clients who are typically life sciences/medtech entities. For established businesses, they’re seeking an exit strategy to sell their business. For emerging technology growth organizations, they’re seeking a commercialization pathway that may lead to an exit.

When thinking of AI and selling a business, the first ludicrous question is “Will a computer acquire our client?” The obvious answer is no. However, it’s clear many strategic and financial buyers are now using some form of AI to help them find acquisition targets fitting within their strategic mandates. On our selling side of the equation, the opportunity is for us to use AI on behalf of our client to find buyers where the value proposition may be maximized for both parties.

Similarly, (for licensing and commercialization opportunities) the opportunity is to use AI to think about the obvious potential strategic fits due to current core medical market segments. Also, it can be used to think beyond the obvious for companies in adjacent spaces where our client’s technology may create a competitive advantage for the strategic partner in a market segment and/or across multiple product lines.

As we go forward in our rapidly changing macro digital environment, we’re excited about using these new tools to continue to create value for buyers and sellers in the medtech and life sciences marketplace.

We’re also enthusiastic about the opportunities for efficiency and time savings. For example, did we write this article or did the computer generate it? For the moment, we can candidly say our blog continues to be self-generated and partially because we haven’t quite figured out how to clone ourselves. Perhaps that day will come?

Meanwhile, we continue to embrace the opportunity to provide personal service to our readers and clients. As always, we value your feedback and welcome your input, even if the computer writes it for you.

MedWorld Advisors

https://medworldadvisors.com

Explore the June 2023 Issue

Check out more from this issue and find your next story to read.

Latest from Today's Medical Developments

- Velosity opens precision development center to accelerate medical device product launch

- A look at the latest in the defense industry

- EMCO manufacturing showroom offers customers hands-on milling, machining engagement

- Workholding Roundtable to feature expert insights on a booming market

- Ilika, Cirtec advance strategic partnership to commercial level

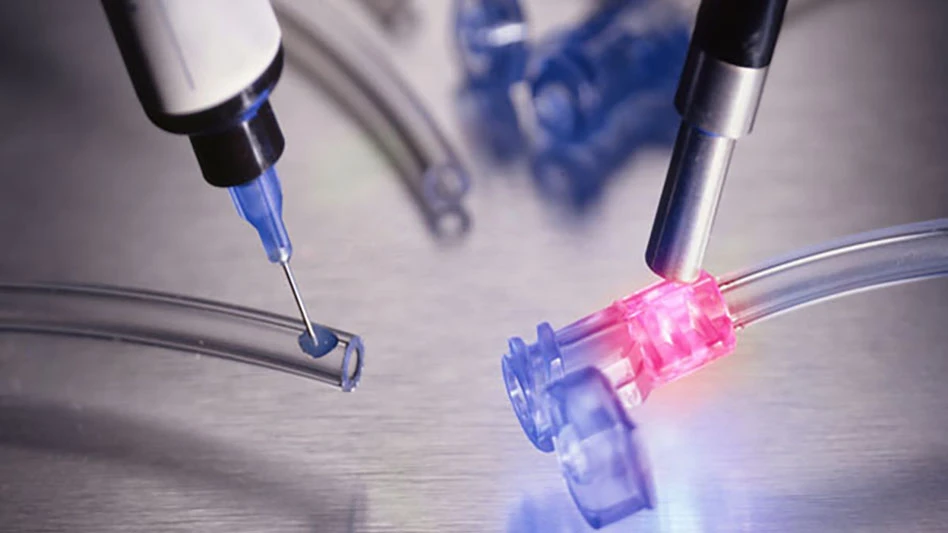

- Engineered fluids offer full lifecycle solutions for medical device development

- Syringe-less injector system for diagnostic imaging obtains fourth FDA clearance

- Hohenstein Medical debuts enhanced medical device testing capabilities